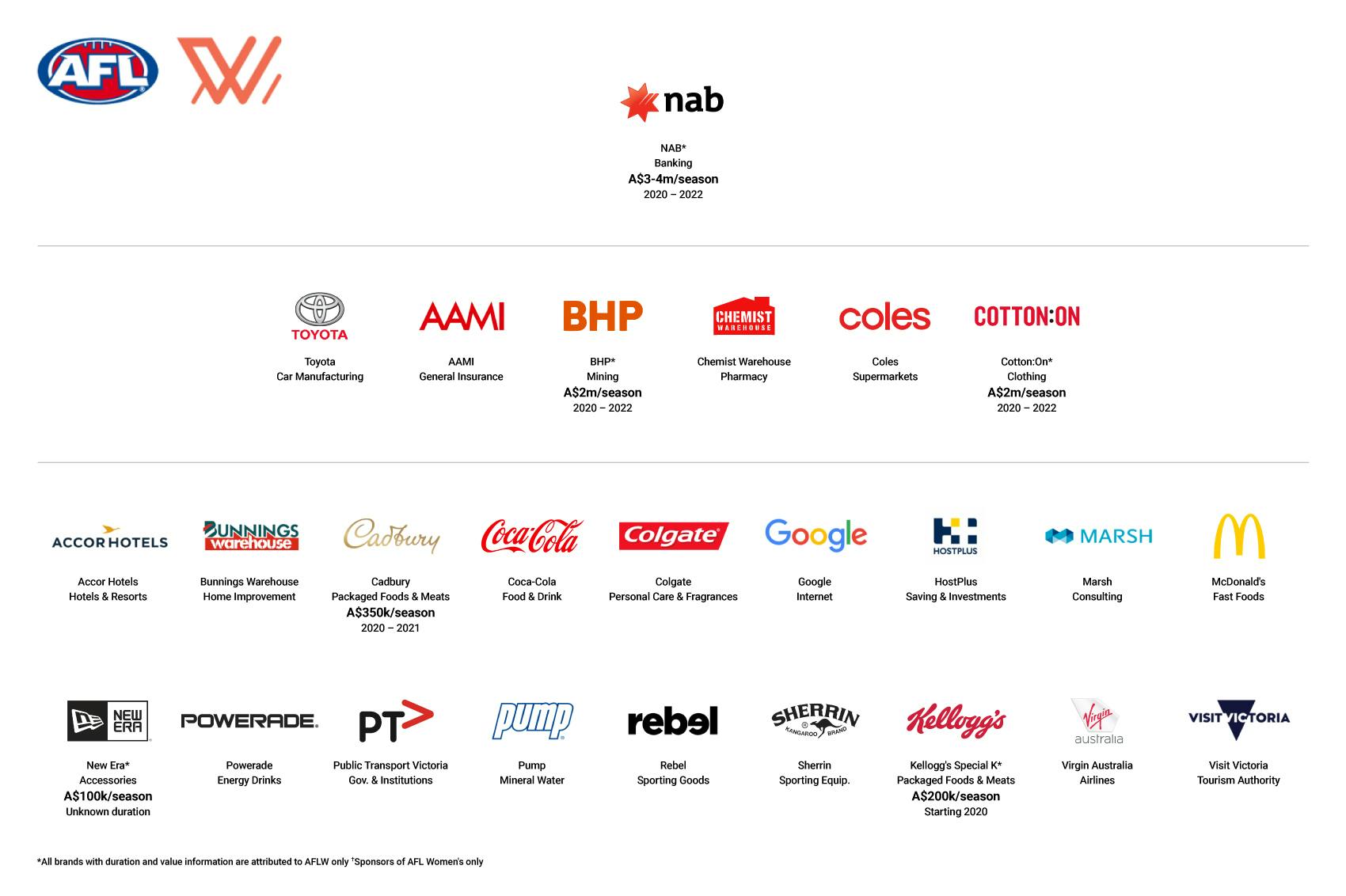

Australia’s five biggest rights-holders – the Australian Football League (AFL), National Rugby League (NFL), Cricket Australia (CA), Rugby Australia (RA) and Tennis Australia – will generate approximately A$330m (€209m/$256m) in central sponsorship revenue in 2021, across a total of 140 deals.

The total accounts for revenues committed at the contract-signing stage and does not account for adjustments to payments that may have been made because of the Covid-19 pandemic.

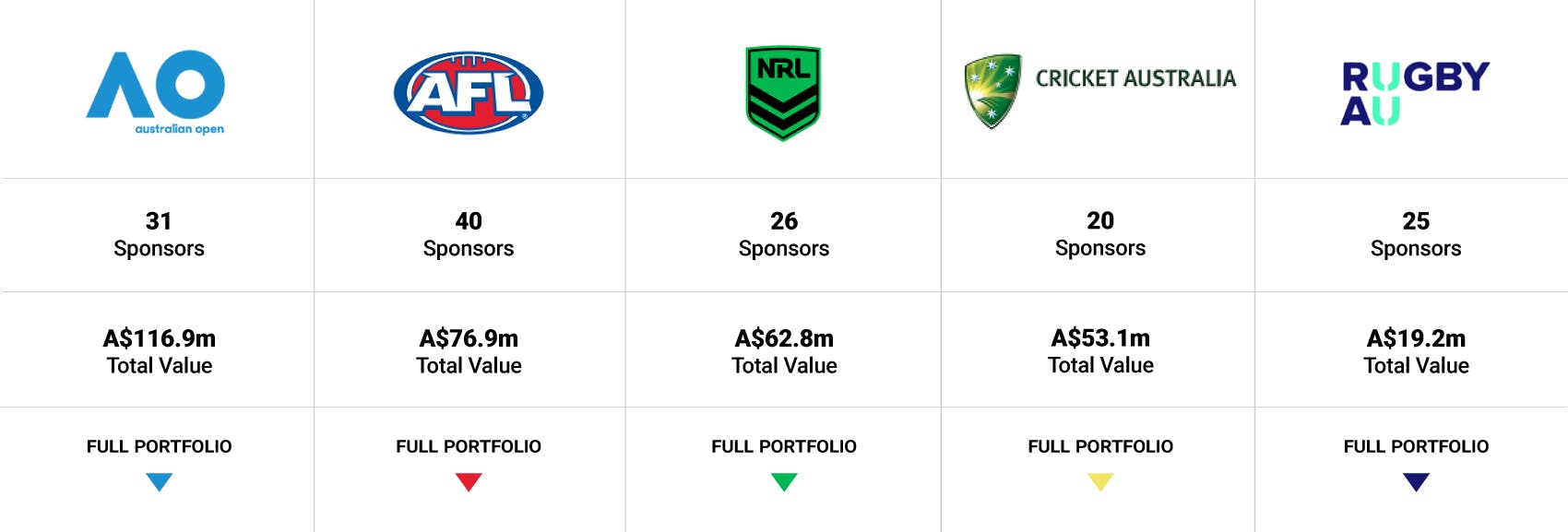

Of the five properties under review, Tennis Australia generated the most revenue, benefitting from its international reach, with sponsorship revenue up to A$116.9m in 2021, from A$107.25m in 2020.

The AFL generated the next-highest total, with revenue of A$76.85m for the 2021 season, above the range of A$72.2m to $73.2m recorded from the 2020 season. This includes the expansion of telco Telstra’s AFL deal to contain rights to the AFL-owned Marvel Stadium. In previous years, Marvel Stadium revenues were contained within an independent entity Melbourne Stadiums Limited. Without this addition, AFL revenue growth was flat.

The NRL registered the biggest percentage increase, up 12.5 per cent from A$55.8m in 2020 to A$62.8m in 2021.

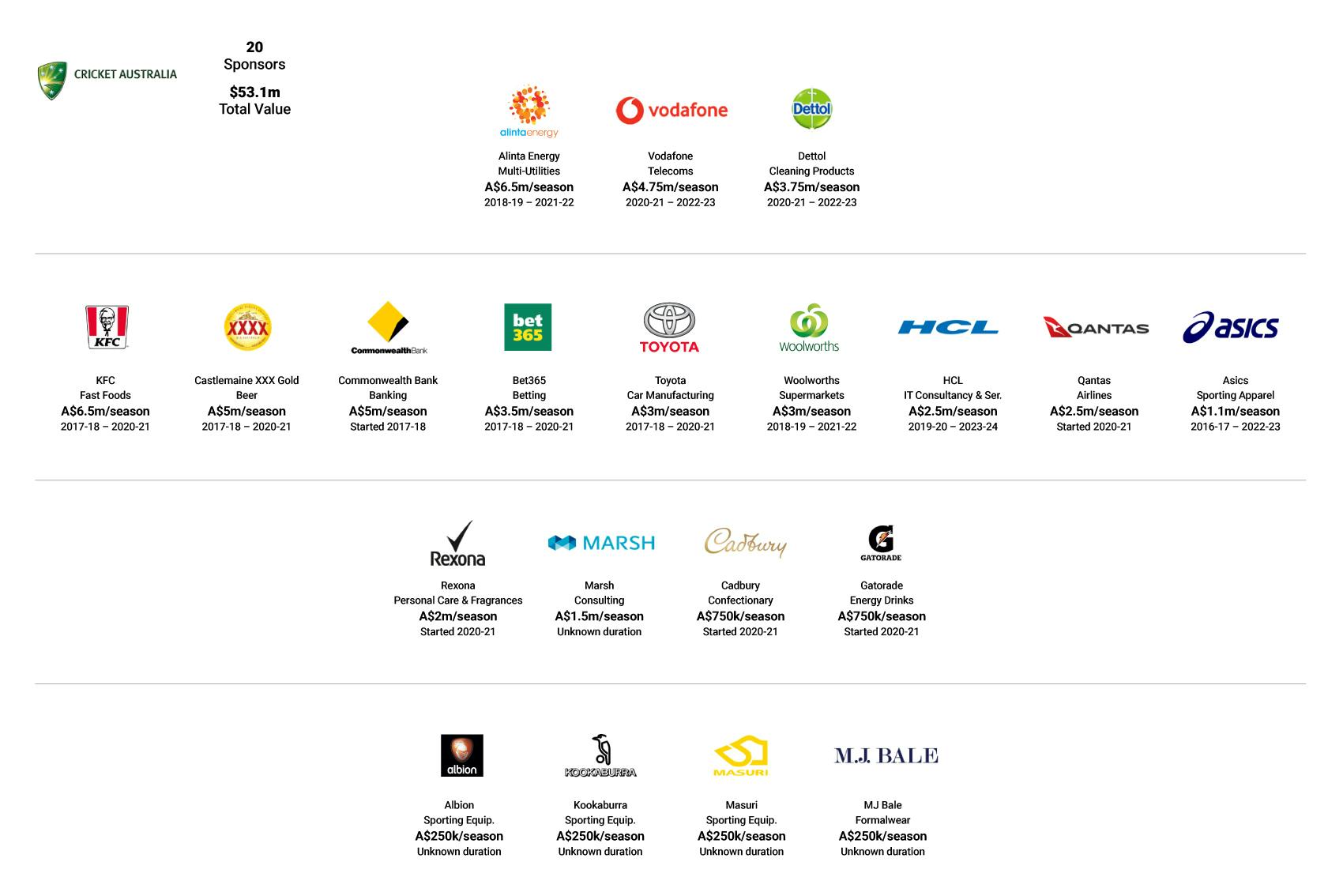

Cricket Australia generated sponsorship income of A$53.1m in 2020-21, the same as in the 2019-20 season [the total from last year’s snapshot has been downgraded by A$2.5m to reflect new value information].

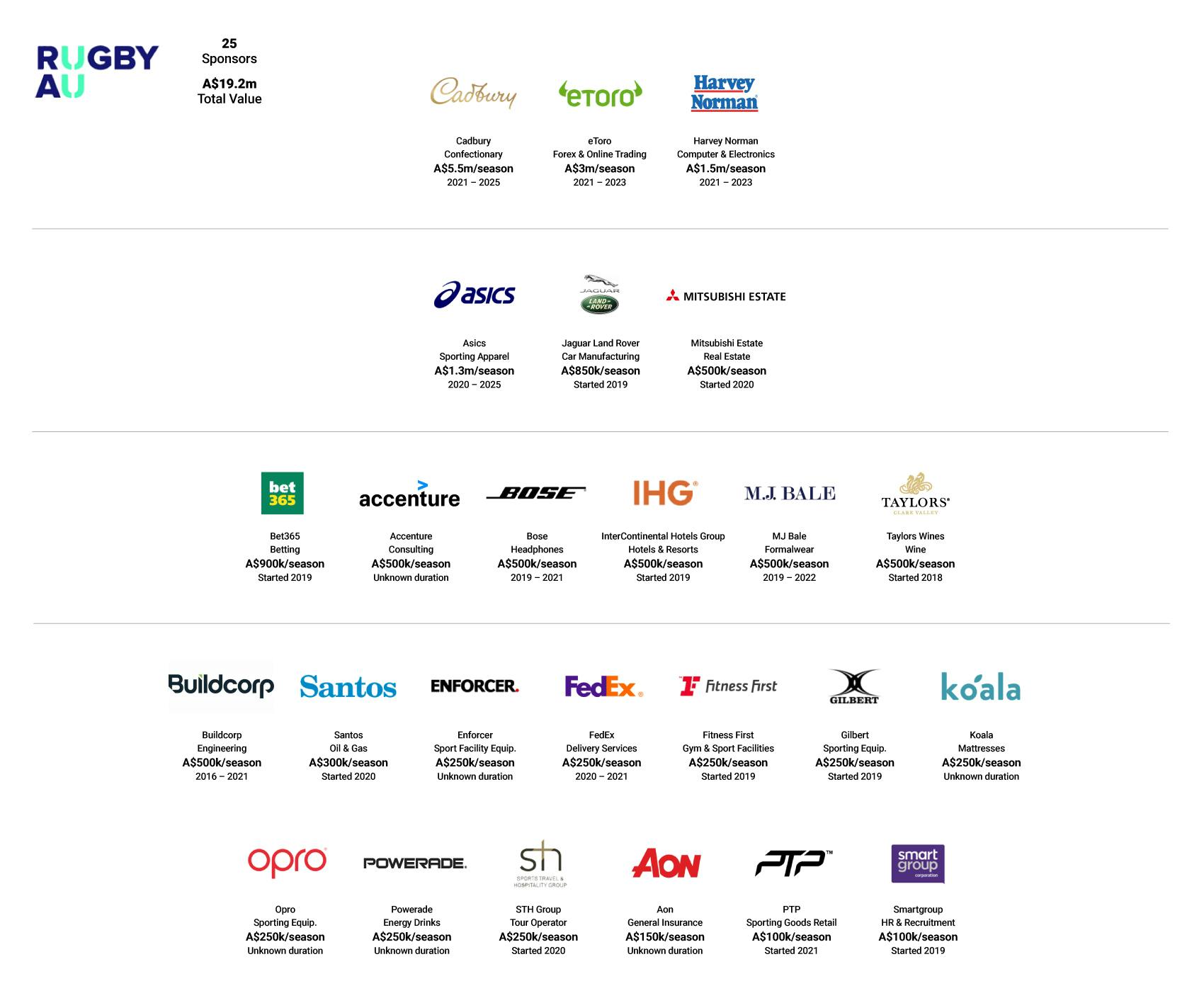

Rugby Australia’s sponsorship revenue was up from A$17.5m in 2020 to A$19.2m in 2021, thanks largely to the addition of confectionary brand Cadbury as its new principal partner in a deal valued at between A$5m and A$6m per season.

MARKET MOVES

Of the five rights-holders, the NRL was the most active, defying Covid-19 with seven new deals. In 2020, this included a major State of Origin naming rights deal with petrol station group Ampol plus agreements with personal care brand Rexona, barbecuing products company Weber, and sponsorships specific to the NRLW with Cadbury and Telstra. In 2021, NRL has added athlete recovery brand Therabody and building equipment rental company Coates Hire to the portfolio. There were also four losses from last season: carmaker Holden, personal care brand Schick, home & garden retailer Home Hardware and winemaker Wolf Blass.

The AFL finalised two new agreements ahead of the 2021 season, with Therabody and tyre company Continental. The league lost eight brands from its official sponsor list, though it is understood some will continue as digital or associate partners: energy company Simply Energy, Coates Hire, life insurer MLC, consumer electronics company Samsung, car rental Thrifty, sports brand Under Armour, powdered drinks brand Nestlé Milo and mining company Rio Tinto. Sportsbet became the league’s wagering partner as a result of its acquisition of BetEasy, which was contracted with the AFL from 2020 to 2025.

Cricket Australia brought in two top tier Platinum Partner deals, with telco Vodafone replacing real estate group Domain as Test match series naming rights partner, and hygiene products brand Dettol replacing personal care brand Gillette as One-Day and T20 Series Sponsor. Confectionary brand Cadbury and personal care brand Rexona also joined the portfolio at a lower tier. As well as Gillette and Domain, Cricket Australia saw opticians Specsavers and payment services company Mastercard depart the portfolio.

Rugby Australia struck three major new deals ahead of the 2021 season, with Cadbury becoming the principal partner of the Wallabies, trading platform eToro becoming title sponsors of Australian home matches in the Rugby Championship, and homeware retailer Harvey Norman becoming title sponsor of Australian home Super Rugby matches. These brands replaced airline Qantas, property developer Mitsubishi Estates and telco Vodafone in their respective categories. Mitsubishi Estates has reset its association with the federation as a major partner. Seven other brands left Rugby Australia’s portfolio: beer brand Yenda, rideshare company Ola, logistics company TNT, electronics brand Sharp, fitness brand 2XU, supplements brand Swisse and clothing company RM Williams.

Tennis Australia saw five new partners sign up for the 2021 Australia Open: fashion brand Ralph Lauren, hygiene brand Initial, energy company Santos, skincare brand Bondi Sands and trading platform TMGM. Additionally, Tennis Australia introduced software company Salesforce to the portfolio for 2021 via a virtual signage placement visible only in Europe, Australia and New Zealand. Brands leaving its portfolio after last year’s tournament were food group Kraft Heinz, skincare brand La Roche-Posay, personal care group Garnier, coffee brand Lavazza, drinks brand Aperol Spritz, pasta group Barilla and fashion company Country Road – the latter ceding the Official Outfitter category to Ralph Lauren.

MARKET ANALYSIS

Pandemic response

All the rights-holders covered here experienced revenue losses on the back of the Covid-19 pandemic.

- Cricket Australia was unaffected by Covid-19 in the financial year to June 30, 2020, because the 2019-20 domestic season ran from October to March before the pandemic took hold. Nevertheless, in June 2020, it projected a A$120m dip in revenue for the 2020-21 financial year, based primarily on loss of ticket revenue from the postponed Australia-hosted men’s 2020 T20 World Cup and lower crowd capacities from its Test and international one-day series against India.

- Tennis Australia is expecting to record a loss of more than A$100m for the 2021 season, based primarily on a reduction in Australian Open attendance to 130,000 (compared to 821,000 in 2020). The Australian Open traditionally takes place in January, but the 2021 tournament was moved to February to minimise the impact of Covid-19 on tournament revenue.

- Rugby Australia reported losses of A$27.1m in its 2020 results, with the final loss underpinned by a A$45.7m reduction in revenue due to the effects of Covid-19, primarily from loss of match inventory in reduced formats involving Super Rugby and The Rugby Championship, which excluded teams from South Africa and Argentina. South Africa has returned for the 2021 Rugby Championship, while the Super League now comprises a five team Australia-only competition followed by a Trans-Tasman series with New Zealand teams.

- The AFL recorded an operating loss of A$22.8m for 2020, in what it called “a year of sacrifices”. Year-on-year revenue fell by A$119.1m to A$674.8m as the AFL and its broadcast partners re-negotiated a revised agreement to provide a reduced 17-round home and away season in 2020, with the 2020 Grand Final played in October. The 2020-21 season started on schedule with crowds returning in force.

- The NRL recorded a deficit of $24.7m in 2020, significantly less than initially expected when the season was first suspended in March 2020. The 2020 seasons resumed in late May and allowed for a 20-round Premiership season, a full NRLW season and the deferral of the State of Origin series to November. The current season kicked off on schedule in March.

Related to the above, revenue retention was the focus for sponsorship departments in the months disrupted by the pandemic, with departments typically maintaining most of their anticipated income, even if it meant some reductions the following season. The outcomes and projected outcome can be summarised thus:

- Cricket Australia expects to generate record commercial sponsorship revenue this financial year, a reflection of the game’s popularity across social demographics in Australia. “We’re grateful to have partners stick with us and we’ve brought on a number of new partners … most of them have been at a slight increment to previous deals,” said Stephanie Beltrame, CA’s executive general manager of broadcast and commercial.

- Key agreements with many of the AFL’s corporate partners were revisited in 2020 to address the altered circumstances caused by the pandemic. SportBusiness Sponsorship understands that the AFL lost some revenue arising from its discussions with sponsors in 2020, but this was “a far cry” from losses it anticipated at the start of the pandemic, and that some of these losses are being recovered in 2021.

- The NRL suffered a dip in sponsorship revenue in 2020 but expects to exceed pre-Covid levels in 2021. SportBusiness understand that 90 to 95 per cent of partners continued to invest at the same level as contracted during the pandemic-effected season, with a very small number of partners pushing for renegotiations. In some cases, revenue was maintained by the NRL offering slightly reduced payments in 2021.

- Rugby Australia lost inventory from the reduction in Super Rugby matches outlined above, while the absence of South Africa from the Rugby Championship also impacted negatively on income. In the season just started, commercial revenues have stabilised following the major deals with Cadbury, eToro and Harvey Norman.

- SportBusiness Sponsorship understands Tennis Australia recouped 86 cents on the (Australian) dollar from its sponsorship portfolio in 2021. The shortfall was primarily the result of non-delivery of hospitality and on-site activation assets. Two sponsors, renewable energy business AgBioEn and Chinese water brand Ganten, remain partners but took a hiatus in 2021, while Ralph Lauren was allowed to defer paying the full value of its contract, starting in 2021, until 2022.

RIGHTS-HOLDER ANALYSIS

Tennis Australia

Internal changes

Ben Slack, formerly director of international business, replaced Richard Heaselgrave as Tennis Australia chief revenue officer after the 2020 Australian Open. Since becoming CRO, he has restructured the AO’s product team responsible for the on-site experience (non-core to tennis) at the Melbourne Park precinct, which includes sites dedicated to food, music, family entertainment and retail.

These functions have been integrated into Tennis Australia’s wider commercial strategy and new hires made from sectors outside sports – including Greta Cooper, director of product and premium experience, from Mondelēz International in the FMCG sector and Rob Pickering as the new director of ticketing and travel from Jetstar Airways.

In the next few months, Slack intends to more closely align TA’s media rights and digital strategy “given that we see a lot more crossover with how we distribute our content out in the marketplace, as opposed to just working with traditional media rights deals… [and] certainly one of the ways in which we’ll monetize that content is through our sponsorships and brands.”

New revenue

In terms of new revenue, TA accelerated the Australian Open virtual signage programme in 2021, allowing sponsors to focus on their key markets. Having previously tested virtual advertising primarily in the Chinese market, coverage from the main court at The Rod Laver Arena in 2021 was produced for five different feeds: Australia/New Zealand, Europe, Japan, Southeast Asia and China. A US feed may be added in future.

With more than 90 per cent of the Australian Open’s viewership and 85 per cent of its digital audience overseas, Slack believes market segmentation will start to be built into new contracts, allowing more affordable deals for brands in Australia that had been forced to buy global rights, while sectors like telecommunications and banking could be divided into multiple regional deals as legacy agreements with global rights start to expire. Slack hopes to start to introduce between two and six new partnerships based on virtual signage before the 2022 Australian Open.

In terms of the current portfolio, the governing body has come to the end of its three-year deal with technology company Infosys, and is in discussions for a renewal, while reserving the option for a multi-partner technology category. Accor Hotels is also exploring a renewal of its agreement and faces potential competition from the Marriott Group, which works with Tennis Australia on the ATP Cup. The credit card, wine and champagne categories are also up for renewal while new partners will be sought in the vitamins and consumer electronics categories.

Cricket Australia

Internal changes

Nick Thodey was made senior commercial manager at Cricket Australia in April 2021, having filled the interim head of commercial role since April 2019. The governing body’s commercial programmes span the national men’s and women’s teams, the Big Bash League (BBL), the Women’s Big Bash League (WBBL), state cricket’s Sheffield Shield and other domestic competitions.

In the role, Thodey is also tasked with starting up a global commercial strategy to acquire new revenue by monetising content and assets in key international markets. The federation currently has an exclusive sponsorship sales agency arrangement for its major assets with the rights management arm of Two Circles.

The focus of Two Circles’ Cricket Australia activity is on series naming rights and global partnerships, with its agents seconded into the client’s commercial department to maintain a close working relationship. It was instrumental in recent deals with Vodafone and Alinta Energy.

In November 2020, Mumbai-based IMG-Reliance was appointed the exclusive global agency to bring on board brand partners for virtual inventory outside Australia, including in the Indian subcontinent. Cricket Australia introduced the concept in the form of virtual end-of-wicket pitch mats and mid-wicket pitch mats visible during live play for India’s tour of Australia in December that year.

New revenue

Cricket Australia estimates it has partners in 80 per cent of the categories it believes are interested in its offering. It is in the market for a credit card sponsor as a replacement for Mastercard, along with insurance, tires, rideshare, motorcycles, financial services and several FMCG sectors.

It was reported that Cricket Australia rejected an offer worth over A$10m per year from McDonalds for domestic Twenty20 Big Bash League tournament naming rights next season, in favour of sticking with long-term partner KFC. The deal with KFC is worth about A$8m per year.

National Rugby League

Internal changes

The Covid-19 pandemic forced the NRL to reset priorities and cost bases in 2020 and 2021, beginning with a reorganisation of its business. As part of that reorganisation, the commercial team merged with the government team to form a Partnerships team focused on growing and servicing both commercial and governmental partnerships in rugby league.

While this policy was driven by the need to maintain close links with government because of Covid-19, rugby league also forms part of Australian policy in the Pacific region, which is receiving an increased level of both private and public investment. The Australian government, for example, is underwriting a Fijian entry into the New South Wales State Cup competition, which may open opportunities for commercial partnerships with tourism and travel businesses.

The NRL partnerships team is led by head of partnership Jaymes Boland-Rudder, who took over from Todd Hewitt in September 2020.

New revenue

One of Boland-Rudder’s first strategic decisions was to sell all perimeter board advertising around this year’s State of Origin series directly. Previously, some inventory had been sold on the NRL’s behalf by outdoor media company QMS.

The NRL sold out its 2021 State of Origin inventory in March and at an increased value for the assets.

Boland-Rudder said overall sponsorship revenue increased for 2021 season on the back of the NRL’s successful handling of the pandemic period, which saw the league return from its Covid-induced hiatus ahead of rival sports in May 2020. This helped generate an uptick in the NRL’S three core metrics drawn from its sponsors: relationship, return on investment and overall experience.

Covid-19 has also been an accelerant of the NRL’s digital capabilities, which – along with the women’s game and Pacific expansion – is a growth focus. Boland-Rudder expects digital-related sponsorship revenue – primarily from branded content or co-created content on the NRL’s social media and digital platforms – to increase 20 per cent next year. Sponsors “got a taste of it [digital content] in the pandemic and wanted more,” he said. “They want more because they realized the power of the IP and the power [in terms of brand outcomes] of bringing stories and being part of the big stories [available] to really avid football fans.”

Areas of potential new revenue include the sale of a car category partner following Holden’s exit as State of Origin title sponsor in 2020. The search was put on hold last year because of the drop off in car sales caused by Covid-19.

RUGBY AUSTRALIA

Internal changes

Rugby Australia has seen top executive level changes since the departure of Raelene Castle as chief executive in April 2020. New chief executive Andy Marinos took over from interim chief executive Rob Clarke in February 2021 after serving his notice period with Sanzaar, where he was also chief executive.

At the commercial level, Anthony French is now director of commercial, Rugby World Cup Bid and external relations, effectively replacing Cameron Murray, the former chief commercial officer, in July 2020. The Rugby World Cup bid relates to the 2027 World Cup.

Peter Sciberras remains in place as the general manger of commercial partnerships, overseeing revenue acquisition and retention of sponsors plus management of ticketing, licensing, hospitality programs and broadcaster relations.

New revenue

Having experienced a downturn in sponsorship revenue partly driven by low audiences for domestic club rugby union and poor performances by the national men’s team pre-Covid in 2019, experts believe that the sport’s return to free to air television offers hope for sponsorship growth.

A new broadcast partnership with Nine, running for an initial three years from 2021 to 2023, will see the broadcaster’s free-to-air channel continue to show all Australian Test rugby and – for the first time – also show one Super Rugby match per weekend, on Saturday nights. All other Super Rugby matches involving Australian clubs will be shown on Nine’s video-on-demand streaming service, Stan.

Super Rugby rights were held by pay-television broadcaster Fox Sports for 25 years from 1996 to 2020. Parent company Foxtel would reportedly have paid more in cash than Nine’s commitment of about $100m in cash and advertising time over the three-year term, but Rugby Australia traded off the smaller cash guarantee for greater exposure.

Andy Marinos said: “The fact rugby is now going to be on free-to-air, it broadens that reach and takes it into homes it probably hasn’t been in for a very long time. Time will tell as we go through the season what the commercial uplift will be and what it will look like, but we are certainly very confident.”

Rugby Australia is also looking at structural changes such as the retention of an Australian club-based Super Rugby competition to generate more revenue at home and abroad. The travel restrictions caused by the pandemic forced a change in Super Rugby’s format for the 2020 season by limiting Australia’s part in the competition to a group of five local teams, rather than the previous format which saw 15 teams compete across five countries (Argentina, Australia Japan, New Zealand and South Africa).

This change was welcomed by many industry experts, who believe Rugby Australia should have more control over its club competition assets, rather than diffuse value and added costs within a multi-market competition. As one marketer said, “the pandemic probably accelerated a change that needed to happen – all of a sudden, it’s okay to kill Bambi.” This year’s competition will start with a five-team Australia-only format and then continue with a crossover competition against five New Zealand teams.

Meanwhile, no national rugby union is pushing harder than Rugby Australia for flexibility on shirt branding at the Rugby World Cup. The Rugby World Cup attracts disproportionate attention to the Wallabies brand and the governing body wants World Rugby to cede some of the exclusivity it holds over tournament sponsors to allow on-shirt branding.

AFL

Internal changes

Kylie Rogers, executive general manager customer and commercial, continues to lead AFL commercial operations but expanded her duties in November 2020 to include marketing, digital media, the AFL’s website and the Marvel Stadium project (the AFL-owned, Melbourne-based stadium is scheduled for a major revamp to be concluded by March 2023).

The stadium was purchased by the AFL in October 2016 but only formally integrated into the AFL structure in 2020 when the independent management of the venue by Melbourne Stadiums Limited (MSL) was ended. The newly formed Stadium Operations team reports to Rogers.

In the expanded role, Rogers will contribute more broadly to the business strategy coming out of Covid-19, which is to prioritise commercial growth and fan experience. “My remit now is to uncover commercial opportunities through getting to know our fans better. How do we better understand what they want? How do we better understand how they engage with us today across multiple platforms? How do we get close to them? The fan is at the heart of our growth strategy,” she said.

New revenue

Key to this fan-centred growth is the refurbished Marvel Stadium and the AFL’s digital ecosystem.

Around the former, the AFL’s vision is “to deliver the best technology, entertainment and sporting precinct in Australia”. Although ticket revenue will comprise its main revenue stream, sponsorship beyond the Marvel naming rights deal will also play a role. In December, Telstra became the official technology and innovation partner for the stadium and the AFL in a move that will underpin the league’s plan to create a “hyperconnected” stadium. Stadium partners, particularly from the food and beverage sectors, should also enhance revenue.

“I have every intention of turning Marvel into a billion-dollar asset,” said Rogers. “We have huge commercial opportunities that come from the redevelopment, and, in sponsorship, it opens up new categories and assets – think food and beverage, events in hospitality, fan engagement, family activations and sustainability.”

As far as the AFL’s digital ecosystem is concerned, digital assets now make up between 25 and 30 per cent of the value of a typical AFL sponsorship package. While three years ago the AFL created five branded content series (content created in association with an AFL sponsor), today there are about 70.

“We pivoted a little in 2020, particularly when we didn’t have live games and started to produce more video content and what I like to call ‘sportstainment’,” said Rogers. “We saw incredible growth last year; video views have increased three-fold… and our commercial partners are investing in that, whether through a 30-second TVC or three-hour documentary, so digital and the commercialisation of digital, whether that’s advertising, branded content or subscription are becoming more and more important.”

KEY DEALS

Ampol/NRL

In October 2020, Australian petrol station brand Ampol signed as the naming rights sponsor of the National Rugby League State of Origin series until 2023, including the Women’s State of Origin, from 2021.

The deal is worth about $6m per year, up on the $5.5m per year paid by Australian car brand Holden, which terminated its deal after ending car production last year.

Ampol is re-launching its brand having retired the name in a merger with the Chevron Corporation-owned Caltex almost 25 years ago. The brand was advised on the deal by the TLA agency.

Matt Halliday, managing director and chief executive at Ampol said the State of Origin’s national stage was the “perfect place” to showcase the re-emergence of the Ampol brand.

Last year’s State of Origin series opener was the most-watched television programme in Australia with a viewing audience of 3.23 million people.

Vodafone/Cricket Australia

In September 2020, Cricket Australia signed telco Vodafone as its Test match series naming rights partner from 2020-21 to 2022-23, at a double-digit percentage uplift on the previous contract.

Where real estate company Domain paid about A$4m (€2.5m/$2.9m) per year until last season, sources told SportBusiness Sponsorship Vodafone is now paying between A$4.5m and A$5m per season.

The uplift was primarily driven by the addition of partner rights to the T20 World Cup winning Australian women’s team and the standalone Women’s Big Bash League.

Cricket Australia was informed last year that Domain would not exercise its option to extend its deal – which covered 2018-19 and 2019-20 – by three more seasons to 2022-23. Cricket Australia targeted a small group of industry sectors not covered by its existing portfolio to find the right partner, including insurance, electronics retail and tyres, as well as telecoms.

Talks with Vodafone began in April last year. The deal was made by Nick Thodey, acting head of commercial development at Cricket Australia, Adam Slattery, Vodafone Australia’s general manager of brand, and Justin Ricketts, chairman of the WPP-owned agency Prism Australia, working on behalf of the brand.

Etoro/Rugby Australia

In May 2021, Rugby Australia extended its naming rights deal with investment platform eToro until the end of 2023, in a three-year deal worth about A$3m per season.

The deal grants eToro naming rights for all inbound Tests including this year’s eToro Rugby Championship and the eToro France series, which comprises three international Test matches in Sydney, Melbourne and Brisbane.

The multi-asset investment platform previously signed on as Australia’s ‘Presenting Partner’ for the eToro 2020 Tri Nations after South Africa withdrew from the Rugby Championship due to Covid-19 concerns, leaving Australia, New Zealand and Argentina challenging for the cut down tournament.

Under the new deal, the eToro logo will continue to feature on official branding as well on the back-right of the shorts of the Wallabies kit.

The agreement was made by the same negotiating that teams that worked on the original Tri Nations deal with Rugby Australia in 2020. Dylan Holman, global sponsorships, senior manager at eToro worked with local agency MGT Projects in initial discussions with Rugby Australia.

Holman said the brand chose rugby in Australia based on extensive research looking at the brand’s existing users and target users. Rugby union, he said, was one of the “top passion points” for them in Australia, as well as in key markets like the UK and France.

TMGM/Tennis Australia

In October 2020, online trading platform TMGM signed its first major sports event sponsorship as the ‘Official Online Trading Platform’ of the Australian Open, in a deal worth between A$4.5m and A$5m per year.

The multi-year deal, starting in 2021, sees TMGM brand the ‘serve-speed’ display, an on-court asset that engages fans both in stadium and through the broadcast.

In negotiating the deal, Tennis Australia engaged directly with TMGM without agency involvement. Angelo D’Alessio, chief marketing officer at TMGM, was the main contact from on the brand side, with Korey Allchin, director of partnerships, and his team managing talks for the rights-holder.

The brand has taken the on-court visibility asset to enhance its globalisation strategy, and the 2021 Australian Open marked the launch of TMGM’s new brand identity, Trade the World, to its global broadcast audience.

Google/AFL

In August 2020, Google Australia made its third deal with the Australian Football League (AFL) in three years when it signed as an Official Partner of the AFL, including new rights to the AFLW women’s league.

Google had signed separate one-year deals in 2018 and 2019 for IP rights attached to the AFL men’s league only. The new deal runs for three years from 2020 to 2022.

Industry experts value the deal at about A$1m per year. The AFL’s new target price for men’s league sponsorships with official sponsor rights is now about A$750,000. The target price for AFLW sponsorships is now about A$350,000 per year.

The deal was made by multiple executives across the Google and AFL teams, led by Kylie Rogers, general manager of commercial at AFL, and Aisling Finch, director of marketing at Google Australia and New Zealand. No agency was involved.

The new deal took longer than initially expected to complete and announce – it was made public in July – because of the Covid-19 pandemic.

Exchange Rate (1st June 2021)

A$1 = $0.77665 = €0.63443