- PepsiCo has renewed with the NHL in a deal worth between $10m and $15m per year

- The sponsorship helped PepsiCo win a major contract with Subway Canada

- The NHL is focused on three key markets: Canada, the US and Europe

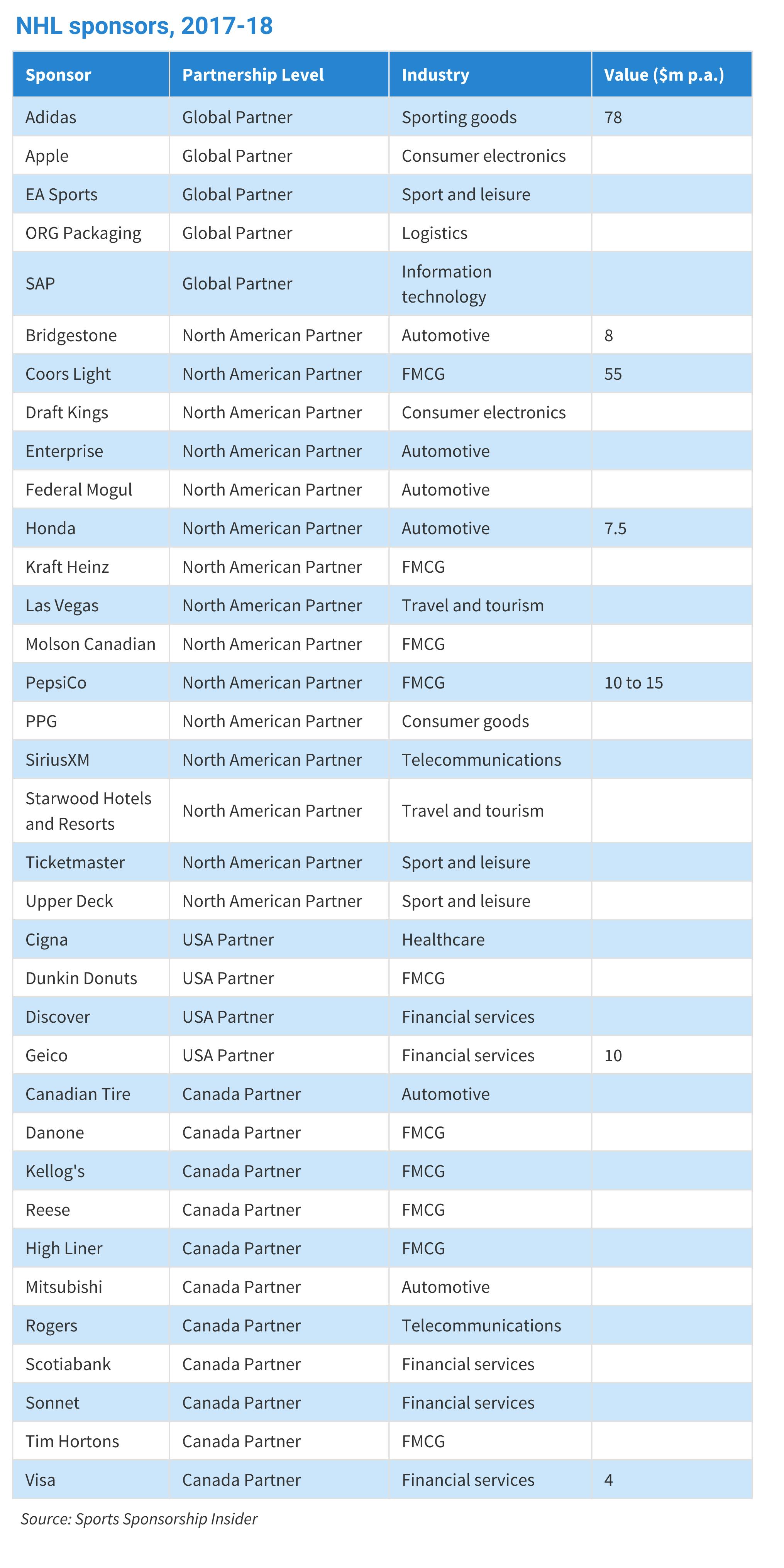

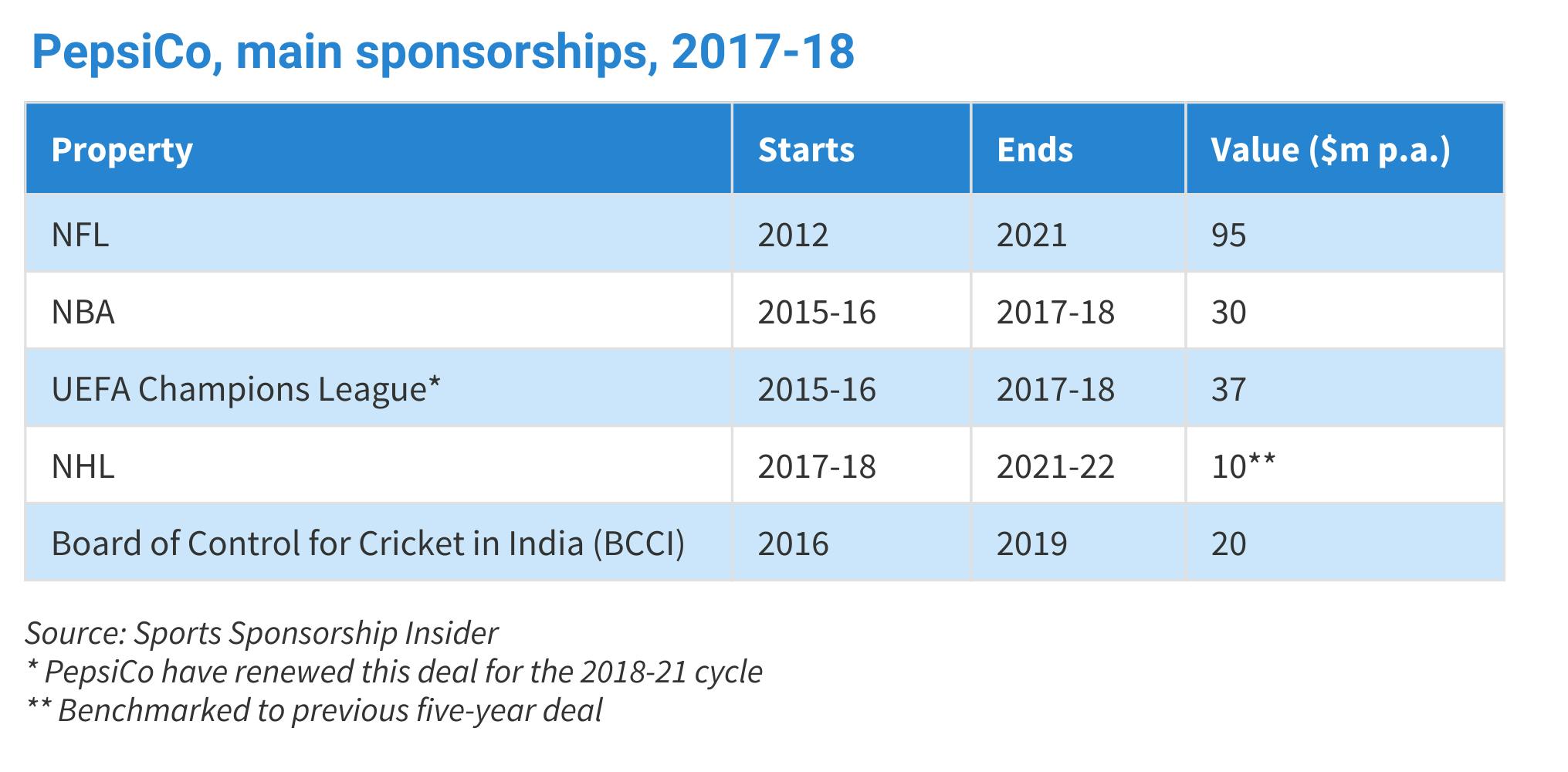

Food and beverage group PepsiCo has signed a five-year extension, from 2018-19 to 2022-23, to its North American partnership with the National Hockey League, a deal understood to be worth between $10m (€8.1m) and $15m per year.

Under the new deal, PepsiCo will maintain the exclusive NHL North American rights in the non- alcoholic beverage, sports nutrition and savoury snack categories.

This season, the Pepsi Zero Sugar brand was activated during the 2018 NHL Winter Classic game on January 1, while Gatorade is visible on player benches and penalty boxes at every NHL game during the season. Tortilla chip brand Tostitos and several other snack products have also been activated under the current deal.

In the new deal, PepsiCo will continue to integrate with the NHL’s media assets and have a strong presence around major events, such as the NHL Stadium Series, NHL All-Star Game and Stanley Cup Playoffs.

The reported fee uplift has been ascribed to the addition of more event and digital assets, though Kyle McMann, NHL group VP of business development and global partnerships told Sports Sponsorship Insider that Pepsi’s deal with the Subway quick service restaurant chain was also influential.

McMann said: “Before this last renewal, Subway Canada – one of the largest fountain pourers in the country – put an RFT [request for tender] up for their carbonated soft drink business, which had been with Coca-Cola since 1999.

“It really became a race between Coca-Cola and Pepsi. We sat down with Pepsi to say let’s expand our offering and the rights you have in that category so that instead of a doing a traditional retail activation we could make a comprehensive partnership in the sandwich quick service restaurant category and give PepsiCo rights to a 52-week activation if they were that way inclined – getting big opportunities for point of sale from the start of season to the play-offs.

“We won’t take all the credit for it – there was a lot of pricing involved, and the value of product and what consumers think if it – but ultimately they won the business and we were able to demonstrate not just to PepsiCo’s marketing team, but to the sales team, that we actually add real value that has a distinct measurable return. They can look at the NHL deal and see the volume that comes from the savoury snacks, chip and drinks business from Subway and understand why they are spending money on it.”

McMann said the NHL is now working with Subway America to see if there are similar opportunities.

Brand insight: PepsiCo

PepsiCo generated approximately $63bn in net revenue in 2016, driven by a food and beverage portfolio that includes 22 brands that each generate more than $1bn in annual retail sales.

PepsiCo’s brand portfolio includes soft drinks such as Pepsi, Pepsi Zero Sugar, Mountain Dew, Gatorade, Aquafina, LIFEWTR, Lipton Iced Tea, Tropicana and Naked Juice and savoury snacks such as Lay’s, Tostitos, Ruffles, Doritos, Cheetos, Rold Gold and Miss Vickie’s.

PepsiCo declined to comment on the deal when contacted by Sports Sponsorship Insider, but it is understood that the groups’ ability to activate many of its brands on different platforms around the

NHL across a 10 to 12-month activation period is key to its strategy.

“Pepsi don’t own title rights for a particular game [like Bridgestone for the Winter Classic or Coors Light for the Stadium Series] but they are omnipresent throughout the season,” said McMann. “PepsiCo assets are in every game we’re doing – be it a rink board, along with ticket and hospitality used for national programmes and key customer account programmes, or through the Gatorade relationship.”

PepsiCo’s combination of popular food and beverage brands also means the sponsorship can be activated with retailers at scale. “We’ve seen tremendous success through the ‘Power of One’ activation around the play-offs and the ‘Back to Hockey’ window at the start of the season which tell fans that something special is happening – our ritual is back or that the play offs are here – and then using that to get a lot of packages on shelves and in people’s houses and the consumption that follows.”

Property Insight: The National Hockey League

The National Hockey League consists of 31 clubs since the addition of expansion franchise the Las Vegas Knights this season.

According to the league, hockey-related revenue, which includes all league and team operational revenue, has grown at a 6.5 per cent compound annual growth rate between 2009-10 and 2017-18, from $2.7bn to a projected $4.5bn. So-called ‘national revenue’, which includes league sponsorships, media and licensing, accounted for around $850m of the total in 2017-18.

It is thought revenue from the 40 or so league sponsors has grown at a mid- single-digit rate per year over the last five years to 2016-17. However, the NHL has stated that core partnership renewals in the last two seasons have driven a 26-per-cent increase in sponsorship revenue.

Core partners include brands such as the food group Kraft Heinz (40-plus years), ticket sales company Ticketmaster (21 years), PepsiCo (16 years), financial group Scotiabank (15 years), tyre company Bridgestone (15 years), fast food restaurant Tim Hortons (11 years) and chocolate manufacturer Hershey’s (10 years).

Broadcast revenue is led by a 12-year, $5.2bn Canadian broadcast deal with telco Rogers and a 10-year American broadcast deal with the NBC network, worth around $200m per year. According to NHL sources, North America television audiences for the regular season grew 79 per cent between 2006 and 2017 and for the playoffs by 110 per cent over the same period.

In terms of attendance, NHL arena capacities were consistently in the mid-90 per cent over the six years between 2011-12 and 2016-17.

Momentum swing

From this solid platform, McMann believes that the addition of the Las Vegas Knights – “already being called the best expansion team in history of sports” – into the highly-competitive league means that hockey has never been “hotter”. “This is also played out in national rights-holder ratings in Canada through Rogers, and we’re seeing a wave of interest in the US on NBC,” he said. “We have a very healthy growth metric from a decade ago and see a compelling swing of momentum.”

On the corporate side, the turnaround has been accelerated by decisions taken by the league to create more moments of fan engagement throughout the season leading up the play-offs.

“I think, first and foremost, we recognised we had 1,230 [now 2,071 with the addition of the Las Vegas Knights] regular-season games and we needed to generate some moments in the season that could really create a moment of inflection and pull attention down to a singular event. There was so much tonnage of game it was difficult to help push the audience to a moment that would allow our partners to make a moment of national activation.

“The Winter Classic was driven by that desire and also NBC’s desire to kick off the day with the highest household television audience outside of the Super Bowl around hockey and get the fan base to experience something unique.

“This has driven corporate success and created a spill-over halo as you go from the Bridgestone Winter Classic to the All-Star Weekend and Coors Light Stadium Game, bridging the mid-season until the strong play-off activation buzz from March to June, when all our national partners activate.”

“In Canada, hockey is the number one programme almost every night that there’s a game during the play-offs and becomes an opportunity for brands to reach a passionate audience and differentiate from their competitors. Bridgestone, for example, will roll into its spring tyre programmes during the play-offs and push out on national television on NBC Sportsnight and in Canada with Rogers and [French-language network] TVA.”

Canada’s influence

North America dominates the NHL’s sponsorship business, but Canada is the financial driver, McMann said. “There’s a disproportionate revenue coming from Canada, but that’s healthy for us. In Canada, there is no bigger game than NHL. We are head and shoulders above any other sports and able to demonstrate incredible statistics around not just our core male 18-34 demographic, but around hockey mums and a female fan base that’s larger than for traditional female sports like figure skating.

“We represent Canada’s passion and are part of the country’s fabric and whether its new Canadians or the existing avid fan base, the funnel is growing. We are pulling more fans into the mix and extending that by getting partners to use their channels to reinforce the game further and create a virtuous circle of conversation around hockey that continues to grow.”

Growth markets

The next wave of revenue growth, says McMann, will come from further refining where the NHL stands in the US sports market and in the rest of the world. In the US, the NHL demographic continues to generate interest. “When we talk to a company around new partnerships or when we sit down with existing relationships for renewals, in the US we have one of the most efficient ways to attract an affluent, educated, white collar force that is demonstrably strong on so many product consumption characteristics.”

Breaking new markets in Europe and China requires greater investment and strategic thought. The objective was framed by NHL Commissioner Gary Bettman in November with the launch of the NHL Global Series, which saw two regular season games played in Sweden, six years after the last regular- season game was played in Europe. “While we currently have worldwide sponsorship and advertising and licensing agreements, for us to really begin to grow the game internationally… we need to have regular presence with events,” Bettman said.

In 2018, The NHL will follow up with regular-season games in Sweden and Finland, and one pre-season game in China. “That’s where we need to see a consistent effort by bringing the game to a local time-zone where fans can experience it live and so drive familiarity, along with direct-to-fan content and coverage from European broadcasters,” said McMann.

“Over time this will grow affinity and fan engagement. Our sponsors are coming from North America but we’re also working locally and will continue to expand our footprint in Europe and China, as the business develops around it – it’s all about taking a superb hot property and growing it in these markets.”

Partner Strategy

McMann believes that NHL partners have a key role to play in driving the sport’s growth in North America and Europe. “I’d be lying to say there’s not a financial component to any opportunity but realistically when you look at what we’re trying to accomplish, the value to our ownership is less about the dollars of a corporate national sponsorship deal and more about the relevancy that it creates and the drive of fandom that it creates.

“By harnessing third-party partners here in Canada, like Scotiabank or Tim Howtons or in terms of what PepsiCo have done in the states with the ‘Power of One’ activation or Kraft Hockeyville [a programme where communities compete to demonstrate their fandom] these pay off much more than the actual revenue that is directly attached to it.

“Across the board, we view the cooperate base as a continuation of the league’s marketing efforts. What we don’t want to see is a deal made for a blocking potential where someone sits on the rights. It’s a negative ROI for them, and we won’t get that accelerator, that bump in demand that we can get from a bank or coffee restaurant, packaged goods or beer company.”

Future revenue sources

McMann said it was unlikely that the NHL will sanction the sale of jersey patches as seen in the NBA in the next three to five years. “The commissioner is very clear on jersey patches and won’t see them any time soon. They are getting a lot of conversation in North America beacsue of the NBA, but the value of these deals is not just the media value, it’s about creating an authentic connection to a team or league.

“While we’re not looking to rush in, if there was an opportunity at the league level where it made sense to bring the entire ecosystem of hockey under one flag and it made financial sense and brought the type of activations that could drive the league forward, it’s something we might look at, but it’s not something we’re pursuing.”

More interesting to McMann is technology around player tracking as part of the live telecast. “The dynamic layering of technology can bring the casual fan into the sport and it’s an evolution that will have a sponsorable moment in the broadcast,” he said.

The use of digitally-enhanced dasher boards as seen at the NHL-operated World Cup of Hockey in 2016 is another area more likely to be commercialised than jersey patches. “We know there is an opportunity at a local level and national level, he said. “The ability to localise the brand message for Canada, the US and Europe is compelling. Fans prefer it, sponsor recall is better, but we’re not there yet in finding the right solution that can be scaled into 31 arenas.”