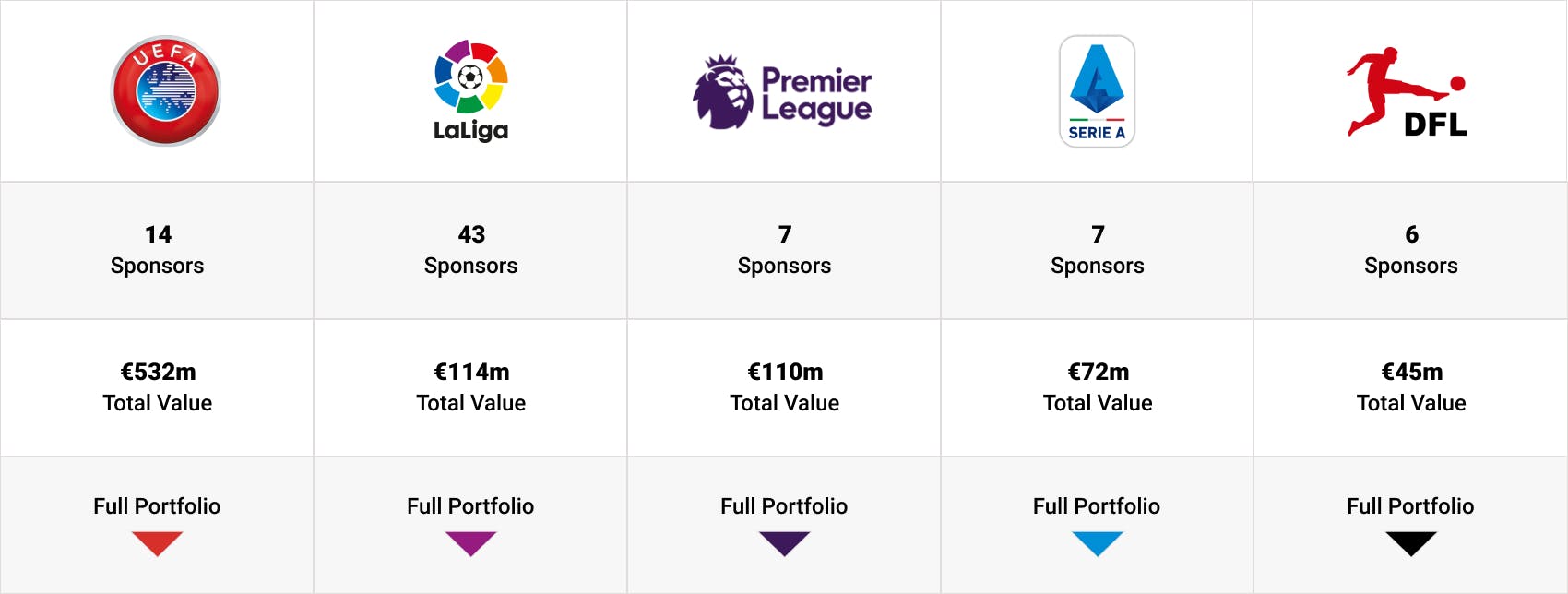

Europe’s four biggest football leagues – plus Uefa’s club competitions – hold central sponsorship contracts worth between €794.4m and €883.3m in 2021-22.

Unsurprisingly, Uefa’s portfolio is the most valuable, at between €496.5m and €556.5m across its eight Champions League and six Europa League/Europa Conference League sponsorships. As 2021-22 was the first season of one of the governing body’s strict three-season sponsorship cycles, it was also the most active rights-holder, with each of its 14 positions either renewed or taken up by new brands.

New to the Champions League portfolio were JustEat Takeaway.com and FedEx, which stepped up from Europa League sponsorship in the previous cycle. Engelbert Strauss, SwissQuote and Bwin joined the ranks of Europa League/Europa Conference League sponsors.

Lega Serie A was also busy coming into 2021-22 as its revamped sponsorship strategy took shape, signing three new sponsors (Crypto.com, EA Sports and Trenitalia) and two renewals.

The Premier League replaced the departing Coca-Cola with tech giant Oracle and has filled its seventh and final portfolio position with Castrol.

LaLiga saw one brand (Microsoft) join its Global Partner tier as another (Rexona) left. It also struck three global licensing-focused deals in the NFT/blockchain space, with Dapper Labs, Sorare and Socios.com. At the national level, Burger King replaced Telepizza after the latter’s agreement was curtailed early, while the impact of Covid-19 was visible in the decisions of Renfe, Danone and Mail Boxes etc. to not renew for 2021-22.

It was a quiet summer, meanwhile, for the Bundesliga, where the only portfolio change was the addition of a licensing-focused agreement with Sorare.

MARKET ANALYSIS

Leagues make their moves with NFTs

Three of the five rights-holders examined in this report have made moves into the blockchain/crypto/NFT categories starting this season.

And while the Bundesliga, LaLiga and Serie A all took different approaches to the sector, they shared a common commitment to serious research before making their moves.

Lega Serie A was the first to take the plunge when it signed a short-term contract with Crypto.com focused on the 19th May Coppa Italia final, with NFTs launched around the game between Atalanta and Juventus.

The pilot partnership was directly inspired by the NBA’s sale of Top Shot virtual trading cards as NFTs – something that also grabbed attention at LaLiga, which signed Top Shot creator Dapper Labs as one of its three NFT partners later in the year.

The Spanish league operator had created a dedicated in-house team to investigate the NFT, cryptocurrency and blockchain space over the previous 18 months, and ultimately chose to split the category between three partners – Sorare and Socios.com joining Dapper Labs.

All three are primarily licensing deals but include traditional sponsorship assets as a means of marketing the NFTs that the league is launching with the brands. The Bundesliga’s deal with Sorare is similarly constituted.

Reports suggest the Premier League is considering launching an NFT collection for the 2022-23 season; Uefa has already invited interest from providers for the 2021-24 cycle.

Team Marketing, Uefa’s sales agency for its club competitions, invited bids for licensing rights to the Champions League in the cryptocurrency, NFTs and fan token space in October. Meanwhile Topps, exclusive official collectibles partner of Uefa’s club competitions, will be able to create NFTs from selected products in the new cycle.

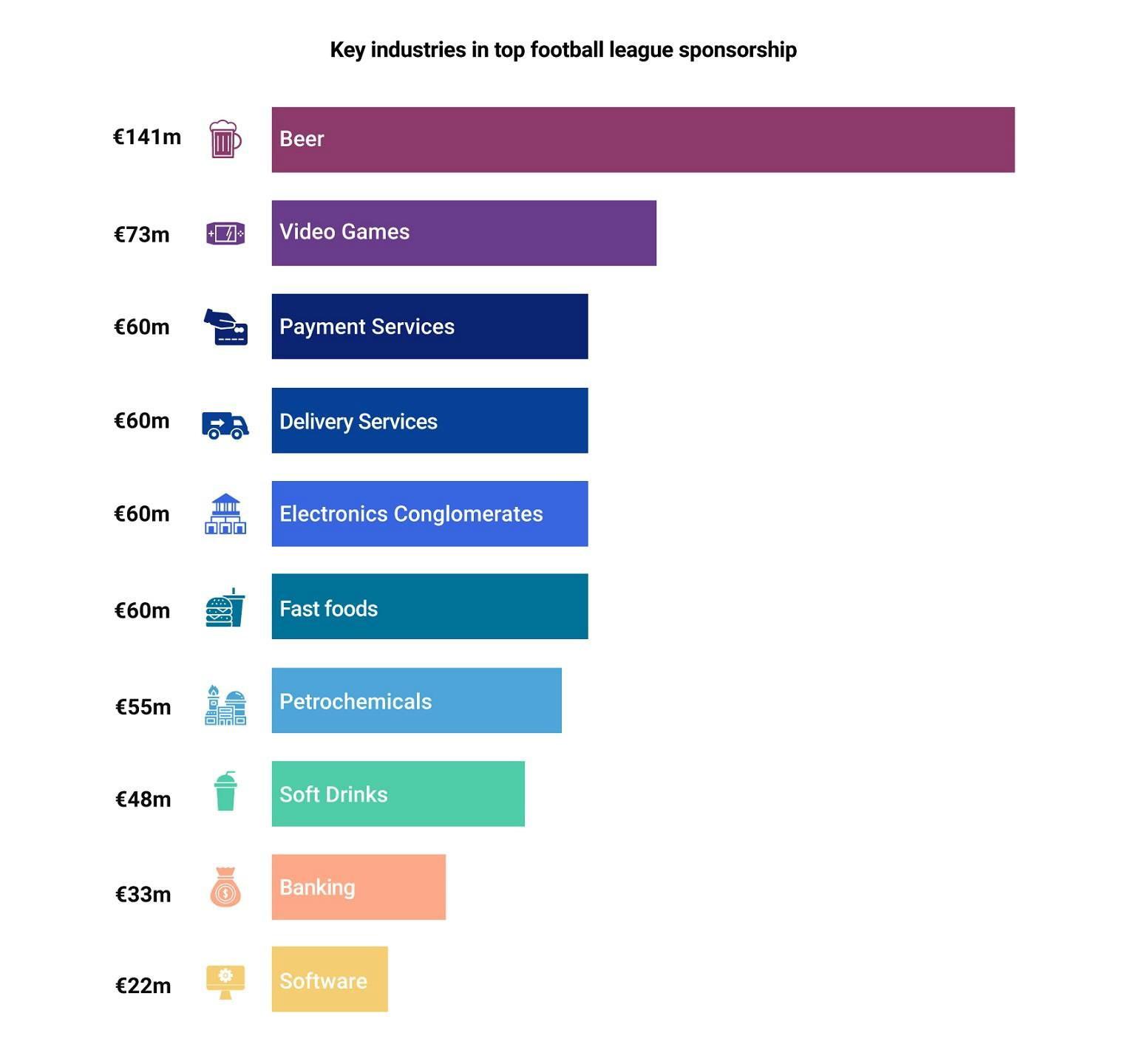

Tech, digital brands rise as traditional categories less prominent

The rise of new sponsorship categories – and concomitant decline of some traditional ones – continued into 2021-22, with the automotive and banking categories notable absentees from Champions League sponsorship, while neither the Premier League nor Serie A enter the season with a soft drink sponsor.

Tech and web-focused brands have filled the gaps, from the Premier League’s deal with Oracle and the NFT partnerships mentioned above to LaLiga’s expanded partnership with Microsoft. JustEat Takeaway.com’s arrival as a Champions League sponsor is another example.

However, experts expect a post-pandemic resurgence in sectors like automotive, with the absence of a Champions League official carmaker more of a Covid-related blip than a long-term disappearance.

RIGHTS-HOLDER ANALYSIS

Uefa

The 2021-22 season is the first of Uefa’s latest three-year commercial cycle for its club competitions. Despite contracting many deals amid the pandemic, Uefa and Team Marketing (its exclusive sales agency for its club competitions) were able to increase the value of Champions League sponsorship about 18 per cent.

Rights around the Europa Conference League, the new third-tier competition, have been sold in packages with the second-tier Europa League. This package is approximate 20 per cent more valuable in the new cycle.

The Champions League’s sponsorship structure is clearly defined with eight global sponsorship positions available. Demand for the positions is as strong as ever: one source described the proposition this season as the “nicest house on the nicest street”.

Uefa uses the strength of its offering to run competitive tenders for the eight positions. Offers for seven were accepted prior to the pandemic – Heineken and Mastercard were the first brands to secure renewal, while FedEx was the third to sign – stepping up from its Europa League position in the previous cycle.

Covid-19 affected the eighth position, where Uefa accepted smartphone brand Oppo’s request to delay its investment by one season. In response, it split the position over the cycle, signing a one-season deal with incumbent partner Expedia.

A major change to Champions League sponsorship for the 2021-24 cycle is the creation of new regional sponsorship packages. These include media, digital and association rights with brands gaining broadcast visibility on LED boards via regional virtual feeds at all Champions League knockout matches as well as the annual Uefa Super Cup.

At the time of writing, two such packages had been in sold to existing global sponsors in Heineken (China) and PepsiCo (US).

Uefa is still in the market with two US-focused packages and one in China. It expects all three to have been sold by the time the 2021-22 Champions League round of 16 begins in February. Covid-driven travel restrictions have slowed down the sales process. As detailed above, the final packages could be bundled with NFT licensing rights.

At the Europa League level, the big change is the addition to the offering of rights around the Europa Conference League, which debuted in 2021-22.

One strength of the Europa League sponsorship offering is that the sheer number of countries it reaches creates a unique opportunity for brands; Uefa believes the addition of the Europa Conference League – which will feature teams from even more, smaller European nations – will only add to this.

However, the 20 per cent value increase into the new cycle was largely driven by the addition of a sixth sponsor to the portfolio, with Bwin becoming Uefa’s first betting partner. It was one of four new additions for the 2021-24 cycle.

No more Team?

Uefa’s RFP to companies interested in selling its club competition commercial rights from 2024-25 has generated huge buzz since October.

The RFP invites interested companies to make offers across either a three- or six-season period – either from 2024-25 to 2026-27, or via two separate offers (from 2024-25 to 2026-27 and 2027-28 to 2029-30) – to sell rights to the Uefa Champions League, Europa League, Europa Conference League, Super Cup and Youth League.

Uefa has worked exclusively with Swiss-based Team Marketing on sales of its club competitions since the inception of the Champions League in 1992-93. Its decision to now weigh up alternatives comes with clubs seeking more influence in the sales process against the backdrop of the failed European Super League proposal.

The RFP is being administered by Uefa Club Competitions SA, a joint venture between Uefa and the European Clubs Association. The ECA represents Europe’s biggest clubs and is chaired by Paris Saint-Germain and beIN Media Group chairman Nasser al-Khelaifi.

Lega Serie A

Overseen by commercial and marketing director Michele Ciccarese, Lega Serie A’s commercial operation was overhauled during the 2020-21 season, and a new-look sponsorship portfolio has taken shape for 2021-22.

Additional inventory has been created, opening the door to new partners like Crypto.com, which joined as presenting sponsor of both VAR and Goal Line Technology (the first time a league has sold rights around VAR). Other new inventory included a new Player of the Month award, integrated with the sponsorship of EA Sports and its FIFA video game series.

The agreement with EA Sports, which also includes title sponsorship of the Supercoppa Italiana from 2022-23 season, means the league has finally addressed an area in which it lagged its peers.

It has also managed to strike a naming rights deal for the 2021-22 Coppa Italia and Supercoppa already, with Trenitalia’s Frecciarossa brand. Last season, the title sponsor of the Super Cup (Sony’s PlayStation 5) and the Coppa Italia final (TIM) signed up only weeks prior to the respective matches in December and May.

The league is keen to add an Official Timekeeper, a sponsor of its manager of the month award and a major International Partner. The latter position opened because the league’s renewed title sponsorship deal with TIM now covers Italy only, where it was previously global in scope. The telco has been granted extended in-country rights, where its business is focused.

The league wants a big international brand, which would be featured prominently on television graphics across its four broadcast feeds outside of Italy (Europe, the Americas, Africa, Asia & Mena).

Agency ISG has renewed its contract to acquire international betting sponsorships for the league, which are delivered via virtual advertising on TV coverage outside Italy. 1XBet has already renewed its international sponsorship.

The ISG renewal also expands the provision of virtual advertising tech – provided to the league by the agency in partnership with Supponor – to all 20 Serie A clubs.

Clubs can simply notify the league of how the virtual assets, which include LED perimeter advertising, CAM carpets and centre circle signage should be deployed ahead of matches, opening regional sponsorship opportunities across the league.

Future plans for the league include the opening of new offices in China, the Middle East and the USA – the latter targeted for the start of 2022 – that will help boost its regional sponsorship sales.

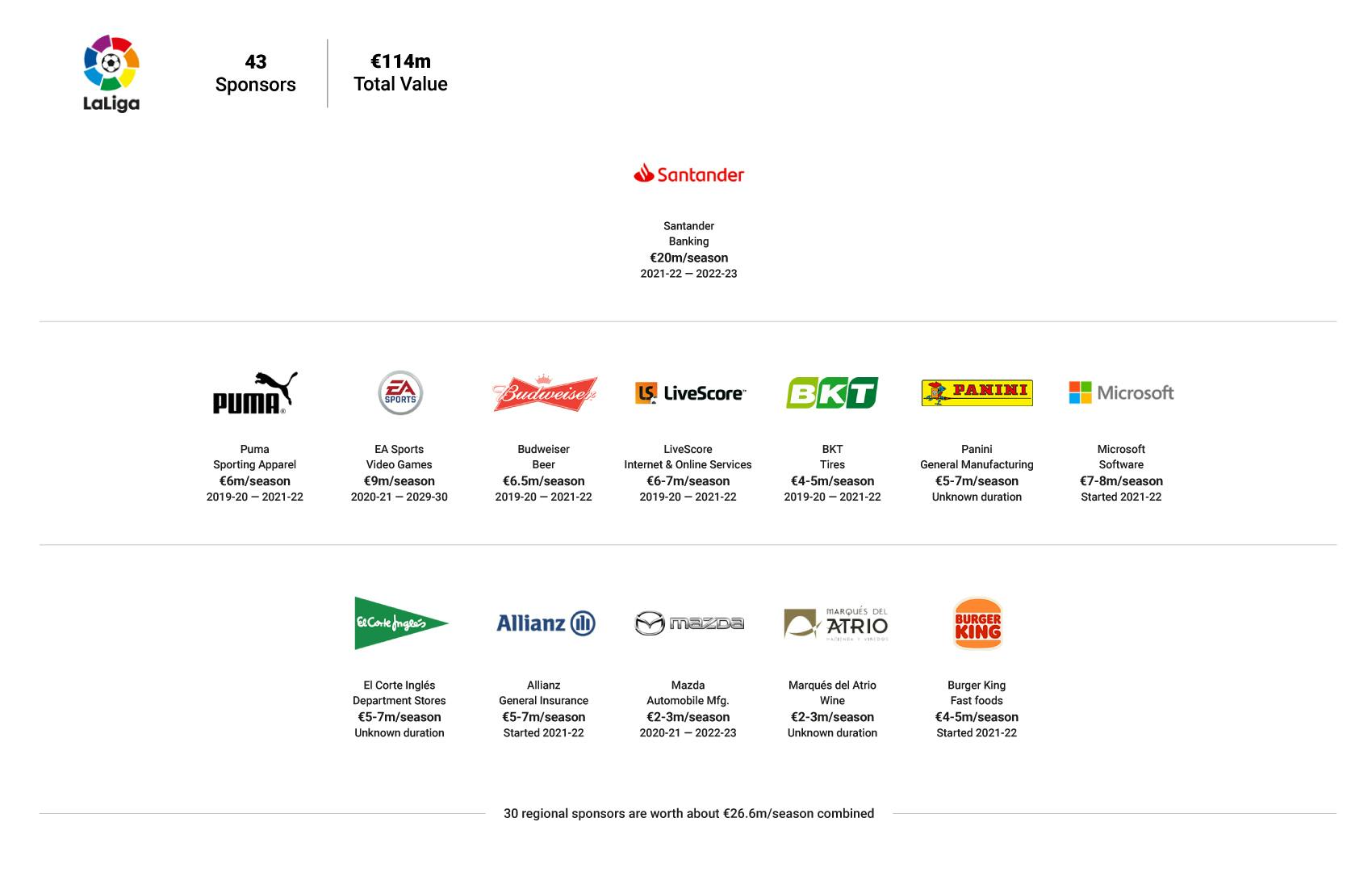

LaLiga

While the impact of the pandemic hurt LaLiga’s partner count – its domestic portfolio shrank from 10 brands to five – the expansion of the wide-ranging association with Microsoft and its three NFT category deals helped to offset the impact on overall commercial revenue. The €7m-€8m per year fee involved in the Microsoft agreement is bolstered by significant amount of addition value-in-kind, with the company’s role as LaLiga’s technology and innovation partner involving support of the development of its technology arm, LaLiga Tech, and its OTT streaming service.

The Spanish government’s new restrictions on betting advertising, which took effect with the 2021-22 season, forced a revision of the league’s deal with domestic betting partner Sportium. Final details of the new arrangement are yet to be completed but it will accord with the new restrictions, though a significant decrease in the brand’s previous €9.5m-per-season fee is to be expected.

The league continues to place a focus on regional sponsorship, supported by its local market presence around the world through its regional hubs and network of ‘delegates’ who work around the globe with responsibilities including the identification of new sponsorship opportunities, activate existing deals

The continued work in this area sees LaLiga’s total number of regional sponsors currently sit at 30, earning the league a total of close to €26.6m in revenue per year.

Premier League

The recent signing of Castrol means the Premier League has filled the seven central sponsorship positions in its portfolio.

The sponsorship strategy remains to partner with global brands that put the Premier League at the heart of their marketing plans, and to act decisively when appropriate opportunities arise.

With the portfolio full, the focus is now on working with existing partners with the fans have been in attendance across all fixtures so far in the 2021-22 season providing a favourable environment for the Premier League to deliver full value to sponsors.

Bundesliga

Barring the licensing-focused agreement with Sorare in October, the league’s portfolio remained stable with the primary focus on working with existing partners on activations. The deal with confectionery giant Mondelēz, agreed in September last 2020, formally started in January 2021,

Bundesliga International, the league’s commercial and marketing arm, continues to take a highly selective approach to the signing of new sponsors. The overarching strategy is to only sign with global brands where there is a clear value add for the Bundesliga itself.

KEY DEALS

Expedia Group & Uefa

Uefa broke its usual sponsorship structure with the signing of Expedia Group to a one-season Champions League sponsorship. The deal, worth just over €20m, covers just the first season of the 2021-22 to 2023-24 commercial cycle for Uefa’s club competitions.

It was an opportunistic move by both parties after it became clear that one of the eight brands from which Uefa had accepted offers for its portfolio positions 2021-24 would not be ready to begin sponsoring the competition until 2022-23.

While neither Uefa nor the brand would confirm, SportBusiness understands this to be Chinese smartphone manufacturer Oppo.

Expedia, which was a Champions League sponsor for the 2018-21 cycle, had failed in its attempt to renew for 2021-24 and was keen to take even the one-season package – especially as it comes at a much lower seasonal cost.

The indication is that Uefa’s offering of a one-year package for the Champions League was highly circumstantial and is not something it expects to repeat again in the future. It was based upon meeting the needs of the market during the pandemic.

PepsiCo & Uefa

In the face of competition from rival Coca-Cola, PepsiCo had to step up its spend to retain its Champions League position for the 2021-24 cycle.

The value of the soft drink multinational’s deal is now in the €40m-€50m per season range – about 20 per cent more than it paid in the 2018-21 cycle.

The brand’s Champions League activation is led by its title rights to the final’s opening ceremony, which was still a high performing asset in both 2020 and 2021 despite reduced in-person attendances.

FedEx & Uefa

FedEx sponsored the Europa League from 2015-16 to 2020-21, as Main Sponsor for the 2015-18 cycle and then as one of the seven sponsors for 2018-21.

The brand had always intended to acquire rights to the top-tier Champions League, and finally found the opportunity in the 2021-24 cycle. It was the third brand to secure one of the eight positions in the new cycle, ultimately paying between €55m and €65m for the rights.

It has significant plans for activation and is keen to leverage the hospitality rights included in its contract to support the B2B side of its business. The extent to which it will be able to do is of course largely reliant on travel conditions influenced by the ongoing global pandemic.

EA Sports & Serie A

Lega Serie A’s agreement with EA Sports is worth between €12m and €14m per season across a long-term contract. It includes title sponsorship of the league’s player of the month award and naming rights to the Italian Super Cup from the 2022-23 season.

There is also a significant licensing element, with the league collectivising the video game rights of 14 of its clubs within the deal, including Inter Milan and AC Milan. Clubs not included in the deal are those with existing associations with Konami.

However, league and brand hope to fold these clubs in to the agreement as their individual deals expire. EA Sports’ deal runs until at least 2024-25.

The deal saw EA Sports complete the set of partnerships with the top four European football leagues.

Crypto.com & Serie A

After initial discussions in late March 2021, an agreement between the cryptocurrency exchange and Lega Serie A was announced ahead of the Coppa Italia final between Atalanta and Juventus on May 29.

Seven NFTs related to the match were created as part of the deal and – while Crypto.com had strong branding presence around the game, including LED advertising, interview backdrops and virtual goal mats – promoting this collection was the focus of the arrangement.

The one-match deal was effectively a pilot project for the league to convince its clubs there was value in collectivising some digital rights to allow centralised NFT creation. And it was successful, as a new multi-season deal worth about €5m per season was announced in August.

Alongside the development of further NFT collections, the agreement includes the designation of Official Innovation and Technology Partner and presenting sponsorship of VAR and GLT, with the league’s VAR centre in Lissone branded the Crypto.com VAR Centre. The company will also be the presenting sponsor of the Serie A goal of the month award.

Telecom Italia & Serie A

TIM’s long-term title sponsorship of the top-tier Serie A was renewed again ahead of the 2021-22 season. The deal will now run until the end of the 2023-24 season, with its value increasing for the first time since 2006, from €15m per season to close to €18m.

This uplift is despite the refinement of the partnership from a global one to Italy only and is due to Lega Serie A adding more domestic rights, including the ability to share match highlights on social media, increased CRM projects and more hospitality assets.

As TIM’s business is focused solely on Italy, the new terms were a win-win, with the league now able to pursue a new international sponsor.

Oracle & the Premier League

The Premier League had held an interest in a tech sector partnership – and a cloud data provider in particular – for some time but had been disappointed that many brands had made heavily VIK-skewed pitches.

Oracle’s proposal was much more amenable to the league, and the deal is understood to have been struck at between £11.5m and £13.5m per season including both cash and VIK.

The brand is granted high visibility during Premier League broadcasts alongside the in-game statistics it provides via its machine learning and data and analytics technology.

Burger King & LaLiga

LaLiga signed a three-season domestic sponsorship deal with Spanish food delivery brand Telepizza in September 2020, but it became clear in the 2020-21 season the company’s strategic direction was changing, and the two organisations decided to curtail the partnership after one season.

With the league still keen to leverage the food delivery sector, the portfolio gap was filled ahead of the 2021-22 season with global fast food giant Burger King. The multi-season agreement is close to the value of the Telepizza deal, at €5m per season.

LaLiga identified Burger King as the ideal replacement for Telepizza due to the success of its ‘Burger King En Casa’ delivery service in Spain, which it operates internally rather than via an external delivery service.

Burger King will be promoted to LaLiga viewers during matches this, while the company’s logo will also be present on the LaLiga ‘Sponsorship U’ – a secondary line of pitch side LED advertising that displays the names of each LaLiga sponsor, granting in-stadium visibility during all LaLiga matches.

Santander & LaLiga

Ahead of the 2021-22 season, Santander renewed its LaLiga title sponsorship for two more seasons, with an option to add a third. The deal’s value remains at the €20m per season mark.

The league was happy to extend what it views as a very positive relationship. It is conscious of the value in having as title sponsor a Spanish brand that has a global presence, aligning with its own position, and it enjoys the security of having a title sponsor from such a generally robust industry.

Because Santander did not renew its Champions League sponsorship, LaLiga is now the bank’s biggest football sponsorship investment.