As this Snapshot was being finalised, F1 signed BWT as an Official Partner in a deal which runs until the end of the 2023 season and is worth $10m per year, with a 50:50 split between cash and value-in-kind.

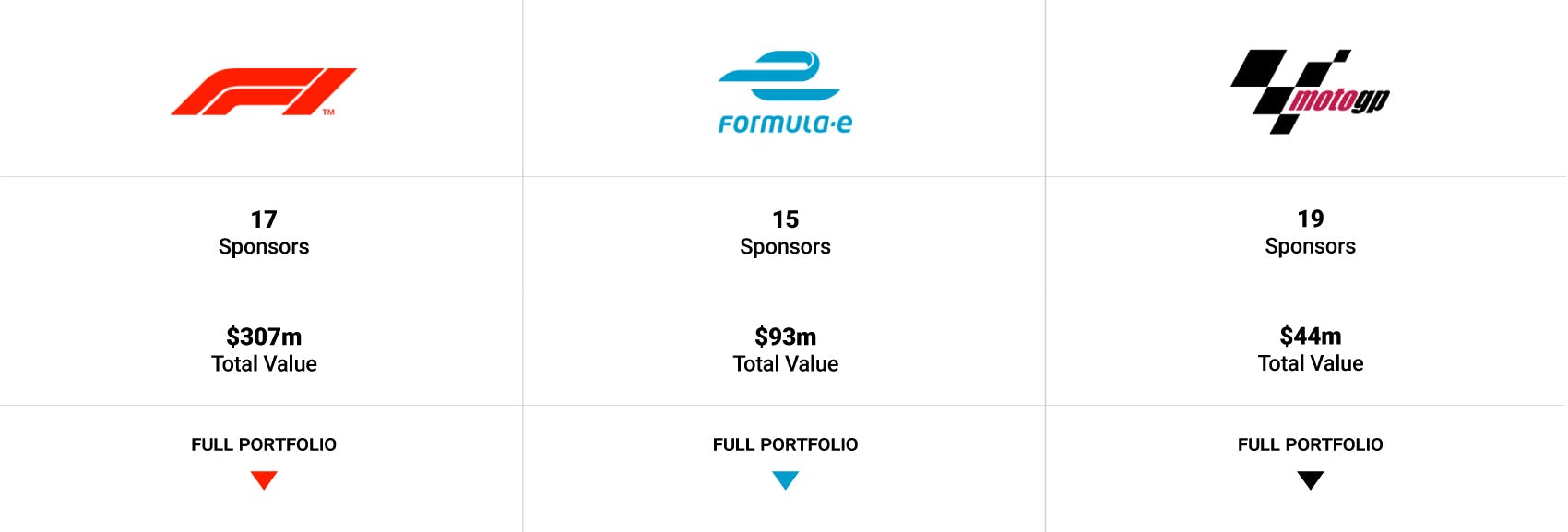

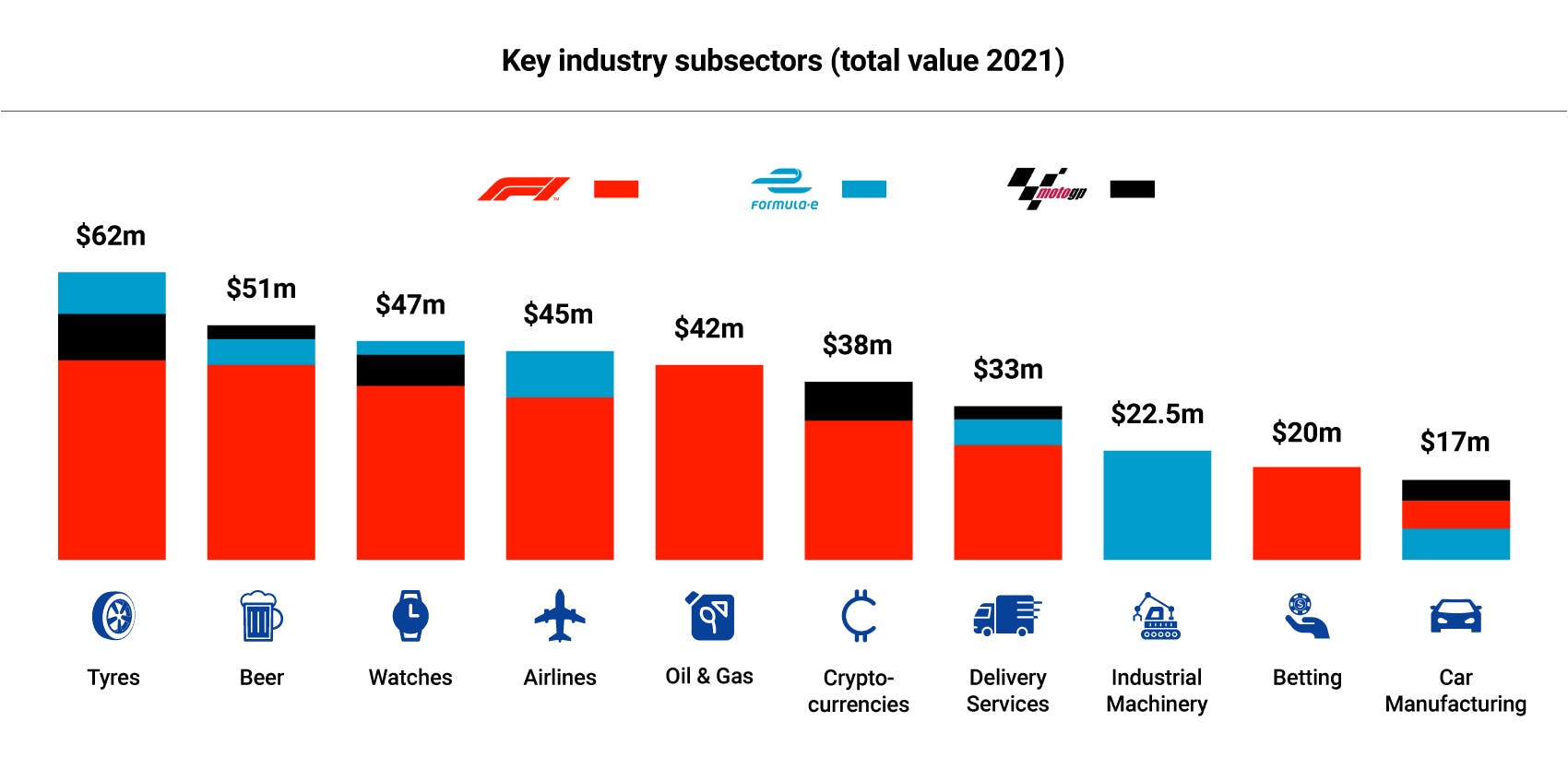

After completing their disrupted 2020 seasons, Formula One, Formula E and MotoGP moved into fresh campaigns in 2021 with a combined portfolio value of between $435m (€370m) and $487m across a total of 53 deals.

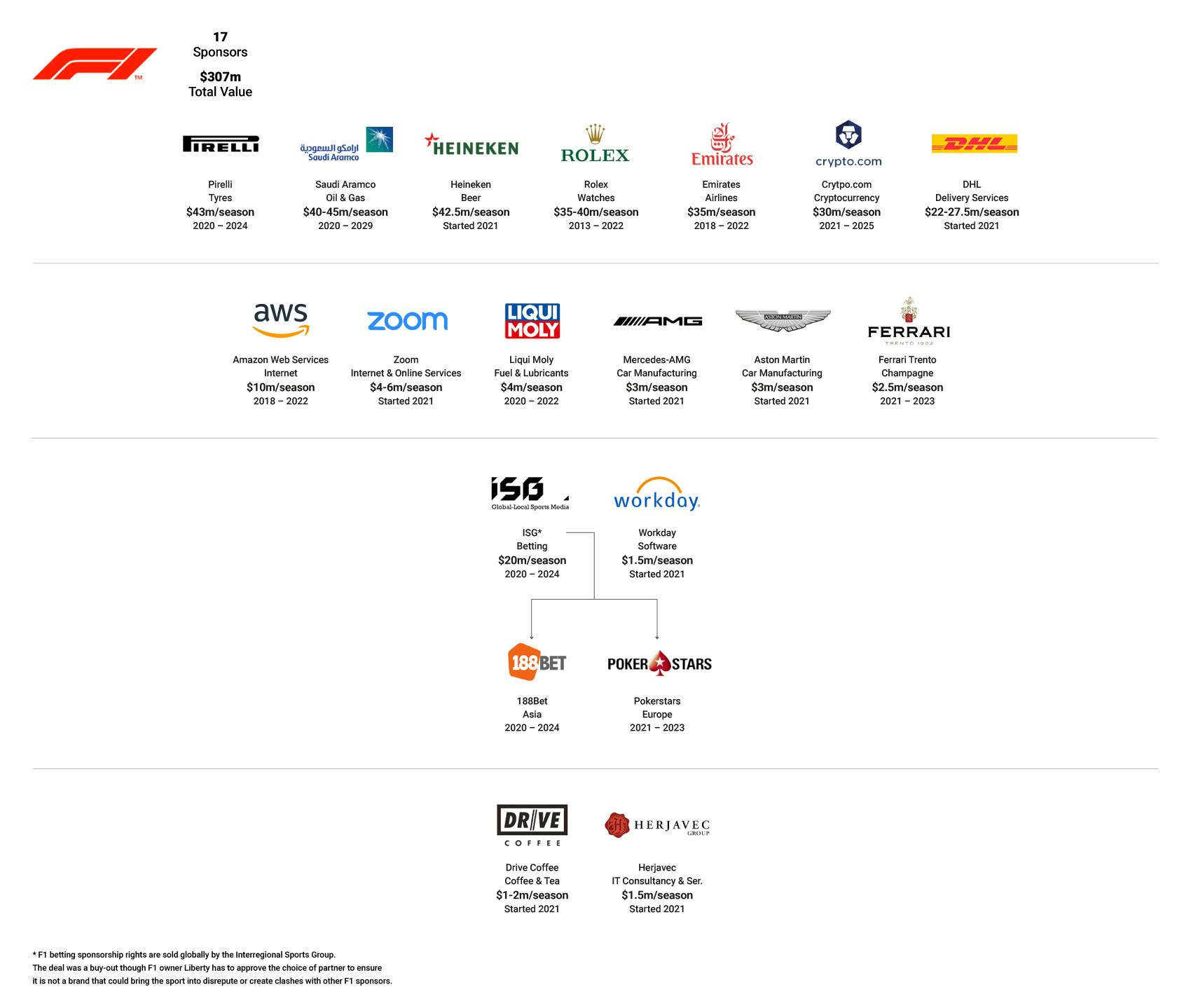

F1’s sponsorship portfolio remains by a distance the most valuable, and its value increased seven per cent per cent on last year’s survey, from about $288m to between $298m and $317m.

This was driven by the June addition of Crypto.com as a top-tier, Global Partner, and the renewal-with-uplift of long-term Global Partner DHL. Lower down the F1 portfolio, Zoom upgraded its association to become an Official Partner, while Ferrari Trento joined the tier to replace the outgoing Champagne Carbon.

Drive Coffee and Herjavec joined as Official Providers while Workday was signed as a regional sponsor in the UK and Germany. Pokerstars was also signed as a regional sponsor by Interregional Sports Group, which sells the rights to F1 betting sponsorships. Deals with Petronas and Securitas were not renewed, while Cyber1 curtailed its agreement due to financial issues.

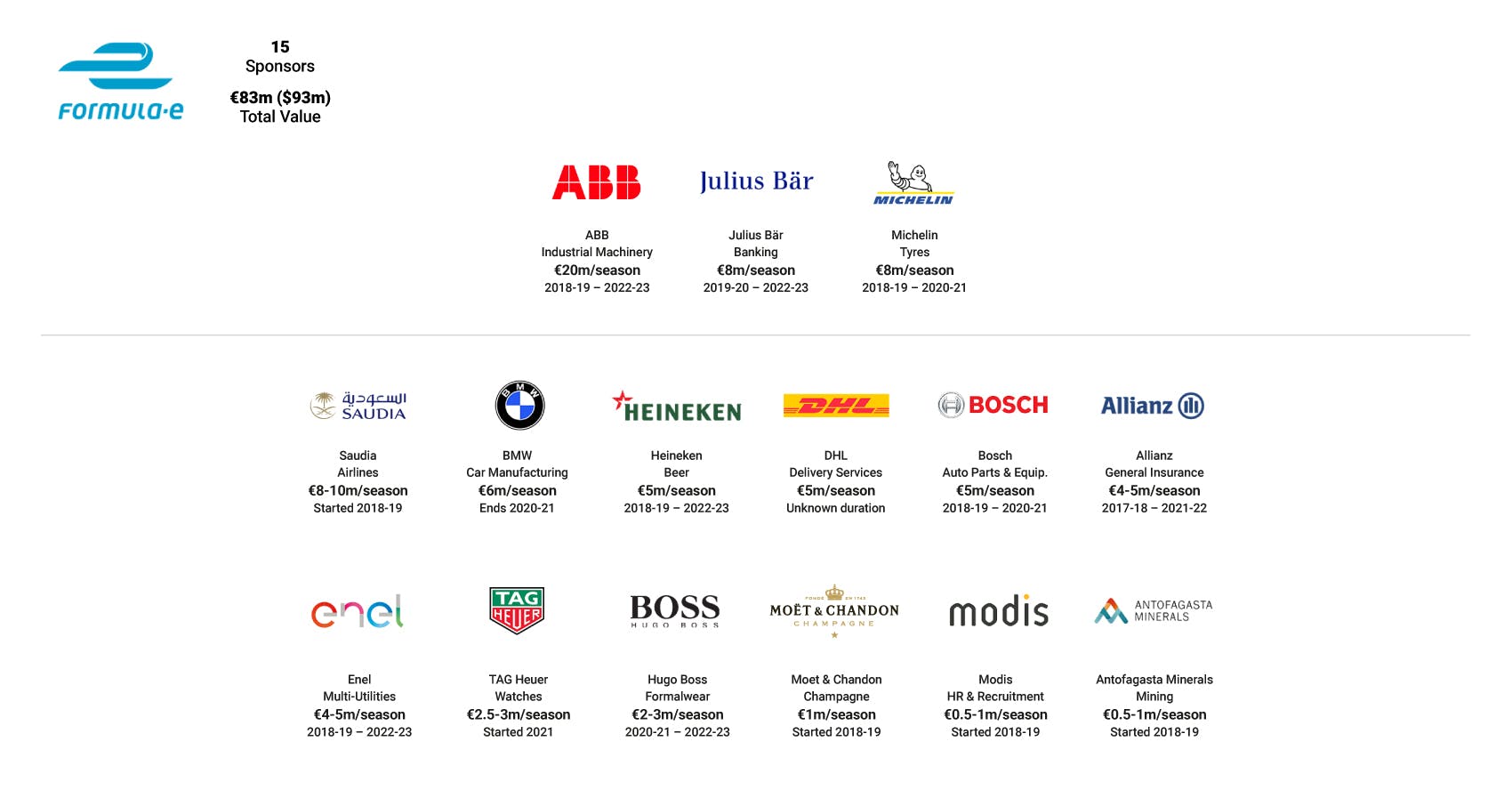

Stability was the watchword at Formula E, which had no sponsors depart the central portfolio and only signed one major deal – a renewal with Tag Heuer. Its valuation – of between €79.5m ($94.3m) and €86m – is almost unchanged from 2020.

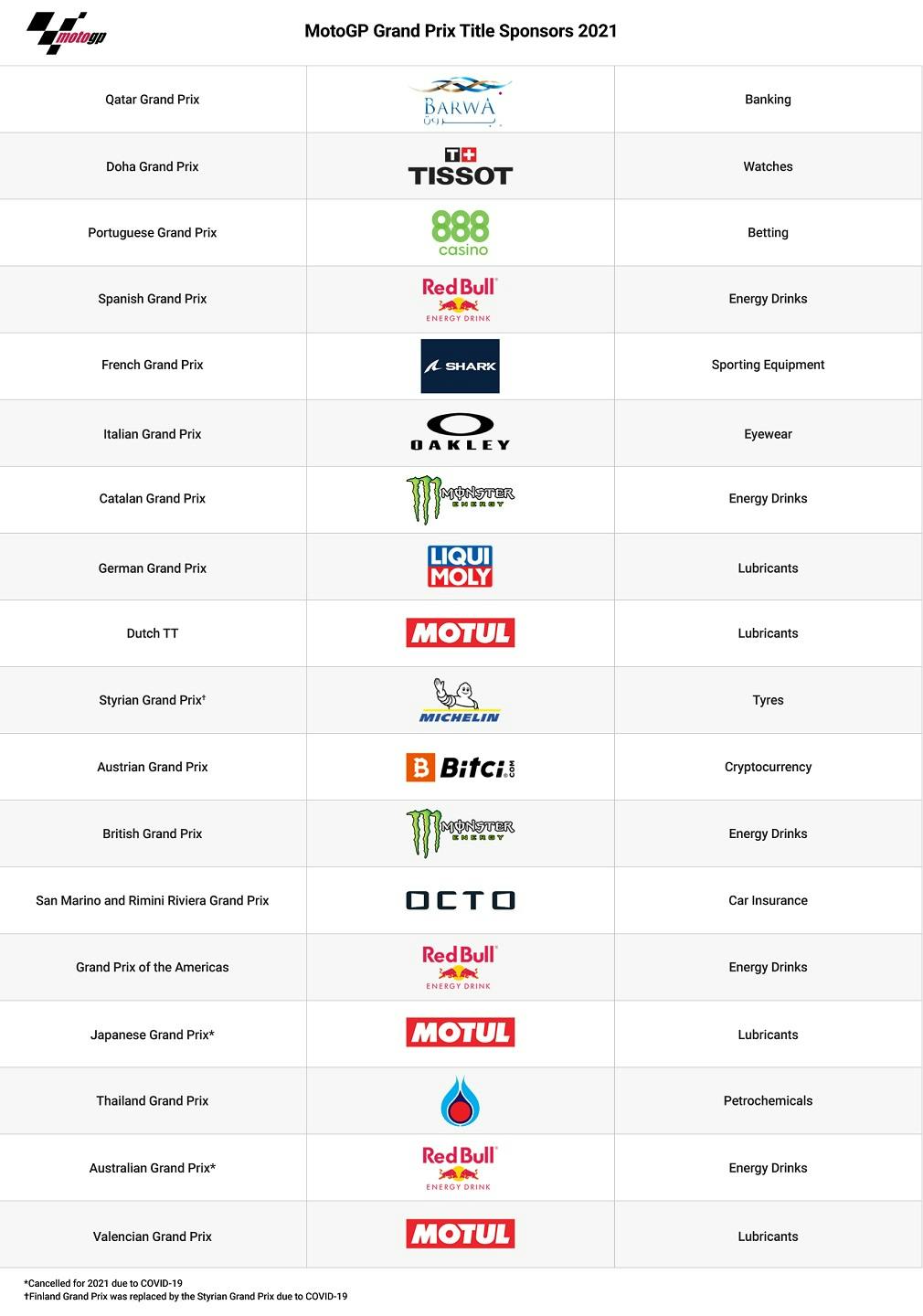

At MotoGP, the addition of Bitci.com as a top-tier Official Sponsor helped drive an increase of at least 19 per cent on last year’s valuation – to between $43.3m-44.3m, from $37m.

MotoGP owner-operator Dorna Sports also signed an extension with W, Lenovo, Oakley, Alpinestars, Hertz and Kenwood. GoPro, Stanley and Scania dropped out of the MotoGP supplier tier, which generally has a higher rate of turnover than the Official Sponsor tier.

MARKET ANALYSIS

OEM exits create questions for Formula E

Formula E went into 2020-21 with several original engine manufacturers – Porsche, Nissan, Mercedes-Benz, BMW and Audi – running teams, an involvement that was felt to support the property’s offer to sponsors.

But BMW and Audi will both exit the series from 2021-22, with sources claiming the manufacturers felt Formula E no longer matched their expectations as a research and development platform, given the standardised nature of the cars.

Brands are wondering what their departures mean for the future of the competition.

Pandemic posed major hospitality challenge

With hospitality assets usually an important element of sponsorship deals in motorsport, F1 and Formula E each took different approaches to how to deliver their value in the context of a pandemic.

F1 worked with Zoom to deliver virtual hospitality during its 2020 season and to create a hybrid model as fans and sponsor guests were welcomed back during 2021.

Formula E also provided virtual hospitality during its 2020 season but pulled out the stops to ensure each of its sponsors could welcome guests in-person to each of its 15 races in 2021.

Despite these efforts, brands told SportBusiness Sponsorship it had been impossible to replicate the value of hospitality in a normal year.

Drive To Survive helps F1 connect with younger audience

F1 continues to score with its documentary series, Drive to Survive, whose third season dropped on Netflix in March.

A study by Nielsen Sport, released in January 2021 just before the new season launched, found Drive to Survive was a key factor behind the youthful 16-35 age bracket accounting for 77 per cent of F1’s audience growth in 2020.

Described in a press briefing by McLaren racing chief executive officer Zak Brown as “single most important impact in North America”, the viewer-to-fan conversion appears to be working particularly well in the US, where F1 broadcaster ESPN reports average viewing figures of 911,000 per race so far in the 2021 season, an increase of 50 per cent from the pandemic-afflicted 2020 season and 36 per cent from 2019.

The season opening Bahrain Grand Prix garnered an average audience of 879,000, beating all the races during the Covid-19 impacted 2020 season.

Drive To Survive has been hailed as a marketing “silver bullet” by F1’s head of digital media rights, Adam Crothers, and has fed into sponsorship sales too, with new US-based partners Zoom, Workday, Drive Coffee and Hong Kong headquartered Crypto.com all saying Drive to Survive helped spark their interest in F1.

RIGHTS-HOLDER ANALYSIS

Formula 1

The last 12 months have seen Ben Pincus, appointed as F1 director of commercial partnerships in February 2020, start to implement his vision.

Primarily, this has involved a more bespoke approach to sponsorship sales, with the team deepening conversations with brands in order to eventually offer a specific package of rights in each deal.

A central aspect of Pincus’s remit when joining F1 was to expand the series’ top sponsorship level, the Global Partner tier, and this was achieved with the June addition of Crypto.com.

In terms of the current state of the portfolio, Formula 1 sees room for one more top-tier, global partner, most likely from the consumer electronics or IT services category.

F1 has rather more headroom to add brands in its second, Official Partner tier. At least one deal is understood to be very close and there is asset space for five more partners. These would ideally include brands in the drinks and fashion categories.

The series’ partnership with Creative Artists Agency, which represents its global sponsorship interests, is due to expire at the end of the 2021 season, but SportBusiness understands the rights-holder is confident the relationship can be extended.

Also ongoing is the agreement with ISG, which sees the group pay $20m per season for the right to sell F1 gambling sponsorships internationally, providing brands with on screen graphics, physical and virtual trackside signage and a presence on F1’s digital and social platforms.

MotoGP

There has been a major shake-up of the MotoGP commercial operation since the May departure of Pau Serracanta, who was commercial managing director at MotoGP owner-operator Dorna Sports for 22 years.

Separate departments for sponsorship and media rights have been unified under chief commercial officer Manel Arroyo. Underneath him are new global commercial partnerships senior director Marc Saurina and Ferran Juncar, who continues his role as global sponsorship senior director. Saurina was formerly executive director of commercial marketing for MotoGP’s sister series, the Superbike World Championship.

Dorna believes easing the exchange of information between the two areas of the commercial operation will make the process of creating sponsorship proposals more efficient. There will be particular focus on improving its use of digital assets, with the closer links between media and sponsorship developing its ability to apply them to individual sponsors in a more bespoke manner.

Discussions with two brands that began before the reshuffle resulted in the July addition of Bitci.com to the top Official Sponsor tier, and Dorna is hopeful of building on this with a second signing in the coming weeks.

Several partners, including top-tier sponsor BMW and suppliers Oakley and Hertz, had deals due to expire at the end of the 2020 season. SportBusiness understands these have been extended but the parties chose not to announce the renewals in the context of the pandemic.

MotoGP’s supplier tier, which currently includes 12 brands, is likely to grow further in the coming months. The way MotoGP manages its events is changing under its new commercial structure and supporting this is the main function of the supplier tier, so the two are likely to evolve together.

Formula E

Formula E maintained a stable portfolio through the height of the Covid-19 pandemic, with no departures between the 2019-20 and 2020-21 seasons. While several deals expire with the 2020-21 season in August, the rights-holder is confident of renewing them all – even the agreement with BMW, which will exit the sport as a manufacturer. A long-term renewal with watch brand Tag Heuer has already been secured.

This season, the commercial team and the wider Formula E organisation focused on allowing its sponsors to welcome guests in all eight cities hosting its 15 grands prix, delivering the hospitality assets included within their contracts.

Chief executive Jamie Reigle is now two years into his tenure, and his team has taken shape. When last year’s snapshot was published, Reigle was looking for someone to run the commercial department and this position was filled in October 2020 when former Red Bull man Olivier Brémont was hired as chief commercial officer. Other new additions include Hannah Brown as chief strategy and business development officer, Aarti Dabas as chief media officer and Henry Chilcott as chief brand officer.

On the new business side, the team is unusually focused on finding brands and categories not typically found in sport sponsorship and considering whether they may well align to Formula E and its key selling points, which the rights-holder posits are sustainability and the urban environment in which its races take place.

For existing clients, Brémont is attempting to scale up the expertise of the existing client services team and adding new members with experience outside motorsport, with the aim of baking in greater creativity in asset offerings and activation planning.

A prime example is the expanded deal with logistics giant DHL, which has taken up title sponsorship of the Valencia ePrix and enacted a huge sustainability-focused activation – planting 400 locally sourced olive trees to turn the trackside green.

KEY DEALS

Crypto.com/F1

In early 2021, Ben Pincus and his team identified the cryptocurrency market as one to explore as a new category to add to the F1 portfolio, and in late June finalised a $30m-per-season, five-year agreement with Crypto.com.

The team had initially thought the crypto market would require more time to mature before a deal was possible, but the speed at which crypto brands have entered the sports sponsorship space brought the anticipated opportunity forward.

Formula 1 therefore went to the market and held initial conversations to 15 to 20 interested cryptocurrency platforms. Crypto.com eventually stood out to F1 because it was interested in marketing to mainstream rather than technical consumers.

Zoom/F1

In 2020, F1 signed a short-term deal with Zoom, the video communications platform whose brand awareness exploded during the pandemic, to help deliver virtual hospitality. It later blossomed into a three-year sponsorship announced in March 2021.

For Zoom, the motivation behind this expanded deal was to provide evidence of its ability as a unified communications platform, beyond the video call function it has become known for. Hospitality will continue to be a focus of its activation, with the Virtual Paddock Club remaining available for Formula 1 to use where required.

DHL/F1

In March, F1 signed a long-term renewal with DHL, its longest serving global sponsor. The new deal came with a fee uplift of about 10 per cent, to between $22m and $27m per season.

The rights-holder saw interest from other logistics brands but valued the loyalty developed during its long association with DHL more highly than the couple of million dollars per year a competitive process may have yielded.

Under the new deal, DHL will receive expanded trackside branding as well as an enhanced involvement in F1’s esports series. The firm will continue to provide its logistics services to support F1’s global operation.

Tag Heuer/Formula E

Luxury watchmaker Tag Heuer has been a sponsor of Formula E since its inaugural season in 2014-15. Its previous €2m-a-season deal ran from 2018-19 through to the end of the 2019-20 season; the new contract is understood to be worth between $2.5m and $3m per season.

It involves a realignment of the rights involved in the contract, with the key change the addition of naming rights to the Fastest Lap.

Speaking to SportBusiness in February 2021, Olivier Brémont explained: “We had to align with Tag Heuer’s strategy over the next five years, so we went back and revised the previous package of rights to make it fit for this purpose.

“The anchor asset is going to be ownership of our Fastest Lap. This speaks very clearly to the role of timing partner but also to having a role in the sport itself and an asset that can contribute to the standings of the sport itself.”

The Fastest Lap has an impact on the standings in the Formula E World Championship Race, with the driver who earns the quickest lap at each event awarded an extra point in the standings.

About Data Snapshots

Each month, SportBusiness Sponsorship publishes a data snapshot of a key sponsorship market: sharing market intelligence, showing the complete portfolios of the major rights-holders and giving vital context to recent deals.

Over the course of the next six months we will looking in-depth at: NBA, MLS, MLB, Tennis, Golf and European football associations.

Check out our archive of past data snapshots.

All the deals included in these snapshots also flow into our global deals database, which has over 28,000 entries across 200+ sports.

How we collect our data

SportBusiness Sponsorship analysts uncover deal data through conversations with rights-holders, brands and agencies. Sponsorship deals carry multiple clauses, bonuses, penalties and non-cash elements. As such our values are necessarily benchmarks that aim to represent VIK as well as cash value.

Exchange Rates used in this snapshot:

€1 = $1.1251